The momentum financial education experienced in 2023 was unprecedented—particularly in K-12 policy. The U.S. officially reached 25 states that have implemented, or are working to implement, a high school graduation requirement. As such, just over 40% of all high school students in the U.S. will be required to take a course in personal finance. This foundation will increase young adults’ knowledge, decision-making skills and confidence as they move into adulthood. Even more significant is that educators, students, advocates, researchers, policymakers, legislators and funders built the case for school-based financial education requirements based on data. NEFE is grateful to work alongside all those who have strived tirelessly to guarantee financial education to all students, no matter their zip code or school.

Financial education momentum was not limited to high schools. NEFE presented alongside congressional leadership and before many national and state agencies as they raised the topic as a top priority for their work. More colleges and universities made the case for on-campus programs, with NEFE’s partnerships exploring access issues among lower-income students and adult learners. Our newly funded research projects came from a near-record number of proposals as NEFE reached an all-time high in research citations. We look forward to continuing engagement with leaders across the country who are advancing this imperative mission.

We celebrate all the success yet realize there is much more to do. Throughout this annual report, you will read about NEFE’s efforts to address the ongoing needs associated with quality, outcomes and access to financial education. This includes setting the stage for the 2024 Financial Education Innovation & Impact Summit in Denver later this year. We remain steadfast in championing effective financial education as one of the cornerstones that ensures everyone has the knowledge, confidence and opportunity to live their best financial life.

2024 Chair, Atlanta, GA

2024 Vice Chair, Columbus, OH

Trustee, Durham, NC

Trustee, San Francisco, CA

Trustee, New York, NY

Chair Emeritus, Rye, NY

Trustee, Irvine, CA

Trustee, Long Beach, CA

Trustee, Palm Beach, FL

Trustee, San Francisco, CA

Trustee, Ithaca, NY

Trustee, Tampa, FL

Trustee, Orange, CA

Trustee, New York, NY

President and Chief Executive Officer, Denver, CO

President and Chief Executive Officer

Senior Vice President, Equity

Senior Vice President, Research and Policy

Treasurer and Chief Financial Officer

Chief of Staff

Managing Director, Research

Director, Research

Senior Manager, Policy and Advocacy

Manager, Office Operations

Manager, Policy and Advocacy

Director, Strategic Partnerships

Managing Director, Media and Executive Engagement

Director, Thought Leadership Initiatives

Senior Manager, Technology

Manager, Administration

Senior Manager, Marketing and Engagement

Senior Manager, Human Resources

Senior Manager, Communications

Director, Business Projects

Managing Director, Policy and Advocacy

Manager, Operations Support

Manager, Marketing and Engagement

Manager, Grants and Research Projects

Manager, Research

Senior Director and Controller, Accounting

Senior Manager, Marketing and Engagement

NEFE champions effective financial education. We are the independent, centralizing voice providing leadership, research and collaboration to advance financial well-being.

NEFE envisions a nation where everyone has the knowledge, confidence and opportunity to live their best financial life.

As one of the first organizations to wholly dedicate its efforts on quality financial education, NEFE continues to embrace and contribute to best practices in collaboration, research and evaluation.

Strategic Plan HighlightsNEFE does not raise revenue through the sale of products or services. Growth of the endowment occurs through the investment of assets. NEFE is a private operating foundation and subject to annual minimum spending rules by the Internal Revenue Service. All charitable activities, apart from research grants, count towards the minimum spending requirement.

2023 Minimum Required Spend

2023 Total Actual Spend

Estimates as of 12/31/23. See 990PF for finalized numbers.

Market Value of NEFE Endowment

Following our inaugural Financial Education Innovation & Impact (FEI&I) Summit, we spent the year expanding and exploring outputs from the Summit as we begin planning our next Summit in 2024.

We used Financial Capability Month—an event we helped create more than two decades ago—to publish our initial FEI&I Summit recaps and blogs, summarizing the presentations and conversations held throughout the Summit in the areas of Access, Quality and Impact:

The ease with which all people can obtain financial education in a way that accommodates different life circumstances (e.g., geography, age, ethnicity/race, socioeconomic status, etc.); the way in which technology improves a person’s ability to obtain financial education.

The quality of financial education and the mechanisms we use to deploy it; the degree to which it adjusts for cultural, economic, racial and geographic differences; the industry’s integration of nontraditional educational methods and patterns of information consumption.

The success with which the industry is advancing financial well-being outcomes among various groups with unique circumstances and needs, what the data shows in terms of successes and gaps, and the quality of assessments in analyzing outcomes.

These were the foundation for our FEI&I Summit Webinar series, which we organized and produced throughout the summer and fall, continuing into 2024 and leading into our FEI&I summit in October. We hope to see you at the event, more details to come soon.

In 2023, we made the important decision to hire our first senior director of Equity—Michelle Samuels-Jones, Ed.D.

Michelle made an immediate impact, expanding NEFE partnerships with organizations that serve underrepresented populations and leading initiatives to build collaborations among key stakeholder champions of equity in financial education.

We introduced Stephanie Cote as our visiting scholar for 2023-24. Stephanie is Odawa and Potawatomi from the Grand Traverse Band of Ottawa and Chippewa Indians from Northern Michigan and serves as a thought leader for the Indigenous population. Her project is a seven-part series exploring Indigenous populations entitled “Financial Education for the Contiguous United States Native Nations.”

We continued partnering with Chloe B. McKenzie, our visiting scholar for 2022, who published several additional research and opinion pieces throughout the year on the topic of financial trauma and financial nonparticipation.

We hit the ground running in 2023 after announcing our new strategic partnership initiative establishing a research-to-practice laboratory to advance effective, population-specific practices in financial education and provide guidance and support for the future of the financial education field.

The ACA partnership is a population study on rural college students, primarily from economically disenfranchised Appalachian communities who tend to be first-generation college students. The seven ACA colleges we funded planned and operationalized their financial education interventions. Six of the seven colleges rolled out their activities for the fall semester—the seventh college's program is launching in 2024. Activities ranged from embedding financial education in a required quantitative literacy course for freshmen to hiring and training paid peer mentors. Assessment results were gathered from undergraduates at these colleges at the beginning and the end of the semester. Colleges are taking lessons from the fall semester to improve the marketing and delivery of their tailored financial education programs.

The CCCS partnership is a population study on community college students. These students tend to be older, more racially diverse, and study and work part-time, compared to traditional four-year undergraduates. In 2023, CCCS hired a program manager to oversee the partnership for the system and an instructional designer to create online modules. In addition, we assisted with preparing options that individual community colleges can elect to offer to their students. CCCS is finalizing its Colorado Skills Institute online program, a platform to enable access for any student or employee of CCCS and all community colleges. We conducted due diligence for a co-funder from the banking or investment sector to offer financial incentives to students who complete the financial education modules.

Billy Hensley gives the keynote address on supporting campus financial well-being initiatives at the Higher Education Financial Wellness Alliance conference in Eugene, OR.

NEFE staff—Amy Conrad, Greg Fischer and Greg Morgan—participated in America Saves’ Financial Wellness Education & Action Roundtable meeting in Washington, D.C.

At FinCon’s “Women in Money” event in Atlanta, Chelsea Norton presented findings from NEFE’s opinion polls on levels of trust in financial institutions and peoples’ feelings about the resumption of student loan payments.

At the Association for Financial Counseling & Planning Education symposium in New Orleans, NEFE staff presented our research and connected with financial education professionals.

Beth Bean moderated FinCon’s “Women in Money” panel in Irvine, CA.

At the Society for Financial Education & Professional Development conference in Washington, D.C., NEFE sponsored the first ever HBCU Fin-Lit Bowl with Michelle Samuels-Jones serving as host.

At the Ragan Workplace Wellness Conference in Denver, Greg Morgan participated in a panel discussing financial well-being and Billy Hensley offers remarks after receiving the Ragan “Hot List” award for our Personal Finance Ecosystem.

Raven Newberry and Emma Donahue present an advocacy workshop at the National Association of State Treasurers’ Treasury Management Training Symposium in Portland, OR.

Paul Golden participated in a panel discussion on the unbanked/underbanked at the Society for Advancing Business Editing and Writing annual conference in St. Petersburg, FL.

Billy Hensley participates in a panel discussion at the National Association of Attorneys General event in Washington, D.C. on the state of financial education.

Greg Fischer presented at the Jump$tart New Mexico conference in Albuquerque, NM.

The NEFE Board of Trustees meets in Denver for their annual meeting.

NEFE values collaboration with mission-aligned organizations to build, deliver and promote programs, initiatives and research focused on financial well-being. Our diverse partnerships span social services, education, research and media organizations.

2023 Speaking Engagements

2023 Technical Requests

The Policy and Advocacy work portfolio expanded in 2023, highlighted by co-hosting “Financial Literacy Day on Capitol Hill” in Washington, D.C., with the Jump$tart Coalition for Personal Financial Literacy. The event returned to being in-person for the first time since 2019, and brought together a diverse group of advocates, educators and policymakers to champion financial education and celebrate efforts. The chairs of the bipartisan Financial Literacy and Wealth Creation Caucus—Rep. Joyce Beatty (D, OH) and Rep. Young Kim (R, CA)—set the stage for financial education as a cross-party issue. NEFE also spoke to leadership groups including the National Association of Attorneys General and the National Association of State Treasurers.

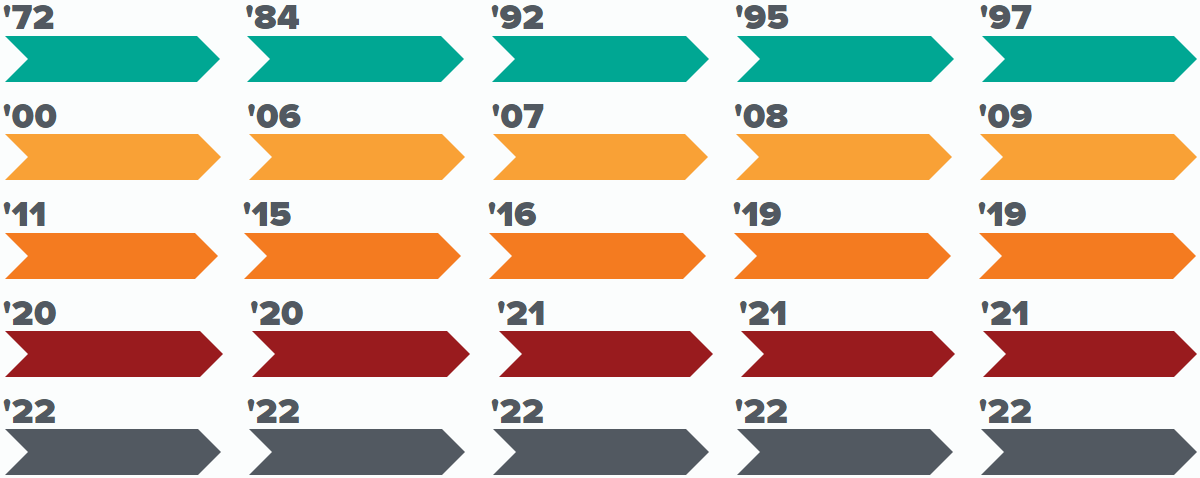

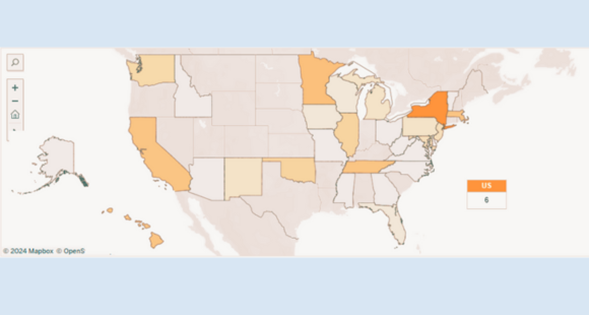

We continued to advocate for K-12 statewide financial education requirements throughout 2023 and were monitoring legislation introduced in several states. By the end of the summer, six state legislatures (West Virginia, Indiana, Connecticut, Minnesota, Louisiana and Oregon) passed bills requiring financial education for graduation, with two additional states (Pennsylvania and Wisconsin) finalizing their legislation prior to the end of the year. This brings the number of states with these policies to 25.

Learn more in our annual legislative recap

For nearly two years, we were monitoring the process for updating the Community Reinvestment Act, a landmark U.S. civil rights law aimed at countering racial discrimination in lending. In October, the Federal Reserve, the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency took steps to modernize a law untouched this century.

Read more for NEFE's reaction to the reformsWe're interviewing people on financial education and financial well-being and why they're crucial to so many. Listen to students, advocates and financial professionals speak on why financial education and wellness is so important.

One of the major enhancements to our website was a new legislative tracker map. This addition enhances our continued work showcasing K-12 financial education legislation being considered at the state and national level.

Gathering data on important issues at key moments set the tone for our opinion poll work in 2023.

We commissioned a series of polls exploring trust in the financial services sector, and how public sentiment shifted in the wake of the collapse of several banks around the world. We also conducted an exploration into financial services interactions among Native communities.

With the end of the three-year student loan repayment pause, we conducted in-depth opinion polling to determine the short- and long-term impacts on both the general population and those with outstanding loan balances.

In addition, we conducted our traditional financial well-being opinion poll to start the year and ended the year researching how Native community members view their financial lives.

Billy Hensley conducted a national satellite media tour in September on our student loan data, speaking to radio and television outlets across the country.

83% of U.S. adults with outstanding student loans say they will need to make significant budgetary changes in order to make their payments.

As 31% of U.S. adults are scheduled to begin repaying student loans for themselves or a dependent, NEFE conducted in-depth consumer polling to determine the short- and long-term impacts facing this population after a three-year pause.

The well-publicized collapses and failures of banks worldwide in early 2023 raised questions on whether consumer trust in the financial services industry was impacted. This polling compares U.S. adults who were aware of these bank crises and those were unaware of the bank crises, asking them questions on confidence, faith, ethics and professionalism in financial institutions.

Lewis and Clark College’s project, “Exploring Racial Ideologies Within the National Standards for Personal Finance Education,” will examine the language within the “National Standards for Personal Finance Education” to identify best practices for educating African American youth about financial literacy.

"I couldn't be more excited and appreciative of NEFE for sponsoring our project. Their support allows us to delve deep into the critical topic of financial education for African American students, and we are determined to uncover valuable insights that will make a real impact. This grant empowers us to drive positive change in financial literacy education, and we are eager to embark on this journey,” says Arielle Hammond, Ph.D. candidate, Lewis and Clark College.

The University of Alabama will use NEFE grant funding for their project, “Finances in Sexual and Gender Minority Couples Toward Inclusion in Family Financial Capability,” examining how sexual and gender minority couples manage their household finances, perceive access to financial services, and assess how financial attitudes and behaviors are associated with financial, psychological and relational well-being.

The University of Alabama will use NEFE grant funding for their project, “Finances in Sexual and Gender Minority Couples Toward Inclusion in Family Financial Capability,” examining how sexual and gender minority couples manage their household finances, perceive access to financial services, and assess how financial attitudes and behaviors are associated with financial, psychological and relational well-being.

“The conversations we were able to have with NEFE were instrumental in strengthening our research and methodology. We especially appreciate their commitment to understanding and repairing systemic inequalities in financial well-being,” Casey Totenhagen, Ph.D., associate professor in human development and family studies, University of Alabama.

A joint project between Montana State University, the University of Wisconsin-Madison and the California Policy Lab at UCLA received a grant for their project, “Can Financial Education Reduce the White-Black Wealth Gap?” to examine if a one-semester personal finance course as a high school graduation requirement has an equal impact on financial outcomes for white and Black students, or if one group is uplifted while the other is left behind.

NEFE offers research funding opportunities annually to advance projects with potential to contribute profoundly to the field of financial education. More details about the 2024 grant cycle will be released in July, and prospective applicants can anticipate submitting letters of inquiry in the fall.

In 2023, NEFE chose three projects from institutes of higher education to receive a total of $579,789 in grant funding. Since 2006, NEFE has funded 43 projects for more than $6.6 million.

NEFE identifies the following topics as research funding priorities, marking a shift in our agenda. While our grant cycle remains open to all eligible concepts, we give preference to well-designed projects that align with the priorities listed below. Our directed research opportunities provide funding for projects that address these topics specifically.

Strong standards of measurement strengthen the case for effective financial education and inspire others to join our cause. We continuously seek to improve the quality of research in our field by evaluating whether our instruments are effective in their measurement. We are interested in re-evaluating current financial literacy metrics and how financial literacy, behavior, perception, knowledge and skill can be measured more effectively.

We seek:

Sensitivity and awareness that individuals' lived experiences vary and therefore measurement validity may differ across populations.

NEFE acknowledges that financial education alone cannot solve the economic inequity that exists across socioeconomic status, race and gender within the U.S. We see financial education as one piece of a broader ecosystem that affects individual financial capability and well-being.

We ask:

We encourage the investigation of knowledge, skill and wealth disparities—especially among populations that statistically are more likely to experience systemic barriers to improving their financial well-being, such as Black, Indigenous, People of Color (BIPOC) communities, and women and girls. It also is essential to consider the framework of intersectionality when examining population-based disparities.

We pursue the study of disparities through the lens of:

Examining bias—specifically as it pertains to personal finance—helps us identify knowledge gaps in our field. By being more inclusive, we can strengthen both our research design and data. For example, individuals without a credit score disproportionately earn a lower income and are underrepresented in many research studies that use credit score as a key variable, thus limiting the income variation of the study's population.

NEFE recognizes that exposure to financial education among youth in the U.S. can vary widely based on the presence or implementation of state mandates and the amount of financial socialization and education within a family unit. Such a wide range of formative experiences creates an inconsistent foundation for the knowledge and skills critical to financial well-being and decision making in emerging adults.

We sponsored awards supporting emerging scholars and investing in, and recognizing, research in the field of financial well-being.

Presented at the AFCPE Symposium to Miguel Quiñones, Ph.D. candidate from the University of Minnesota Twin Cities, the award celebrates the individual(s) or organization(s) that best demonstrates the effective collaboration of research and effective practice.

NEFE supported several awards at the 2023 Cherry Blossom Financial Education Institute, including sponsoring the Financial Literacy Research Award for two outstanding papers and the Rising Financial Literacy Scholar Award, examining household levels of financial literacy and its impact on fertility and housing policies.

NEFE disseminates research, poll data and provides support to journalists in their consumer finance reporting. NEFE is frequently cited in media outlets across the country.

2023 Total Media Mentions

Overall Coverage in Top-Tier* Media Outlets

*Top-tier = outlets with national reach, syndication of content and/or have reached over 500k impressions

Greg F. and Peggy, winners of our “International Fútbol Challenge” (photo bombed by Josh).

The NEFE staff takes Halloween traditions seriously.

Chelsea hosted a panel after the screening of “This Is Not Financial Advice.”

In a serendipitous bit of luck, NEFE staff had seats near each other on a flight to New Orleans.

“Take me out to the ball game...”

Billy hamming it up at the Financial Education Institute event while Beth looks on.

Staff stopped at a local coffee shop during a practice evacuation. Safety first!

The policy team hosted a Financial Education Hill Day event near the Colorado state capitol building.

Members of the NEFE Engagement team in Washington, DC.

Billy and JJ enjoying a quick game of bags/cornhole during the October Board meeting.

Staff work throughout the year to sharpen, refine and learn new skills.

Staff traveled to Washington D.C. to participate in Financial Literacy Day on the Hill.