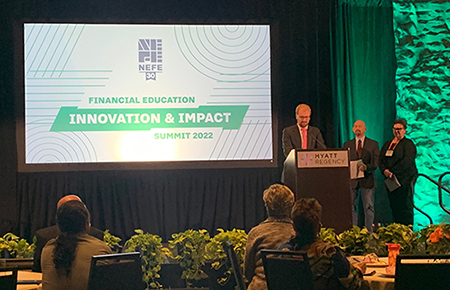

NEFE launched our redesigned strategic partnership initiative in 2022, starting with an announcement at our inaugural Financial Education Innovation & Impact Summit.

The initiative establishes a new research-to-practice laboratory to enable us to champion and advance effective, population-specific practices in financial education and provide guidance and support for the future of the financial education field. We will be making a significant investment in this initiative.

Partnership Projects

Our first strategic partnerships are in two geographical areas representing different underserved higher education students. We have invested $2.5 million for this collaborative research on financial education programs and services that are tailored to the needs of their unique populations.

Our first strategic partnerships are in two geographical areas representing different underserved higher education students. We have invested $2.5 million for this collaborative research on financial education programs and services that are tailored to the needs of their unique populations.

The Appalachian College Association focuses on first-generation, rural and lower-income college students in Georgia, Kentucky, North Carolina, Tennessee, Virginia, and West Virginia. The 34 colleges of the Association serve 77,000 students.

The Colorado Community College System encompasses all 13 community colleges across the state. The colleges primarily serve a minority population of working adult who study part-time, reaching 111,000 Coloradans. They were chosen due to their strong histories of providing direct services and programs to their respective communities, their ability to implement a pilot program tailored to the needs of their specific populations and their commitment to financial education access.

ACA Interim report

In December 2022, the National Endowment for Financial Education (NEFE) partnered with the Appalachian College Association (ACA) to pilot financial education interventions at seven colleges. These interventions included new credit-bearing courses, online modules on personal finance topics, lecture series, financial coaching programs, and other activities. NEFE engaged ICF, an independent research firm, to evaluate the impact of these interventions on students. The theory of change posits that improving financial education will lead to better financial decision-making, habits, and long-term well-being. ICF used a quasi-experimental design to estimate the effects of financial education programming on college students' financial knowledge, skills, behavior, and well-being. The treatment group consisted of students at seven colleges that received funding from NEFE to implement interventions developed for their unique contexts. The comparison group consisted of students at three ACA campuses that did not implement financial education programming. Student outcomes and satisfaction were measured using a survey administered before and after students participated in the interventions at treatment colleges and at the beginning and end of the academic year for comparison colleges.