Our Annual Report reflects on the remarkable progress and achievements of 2024, a year characterized by tremendous economic, political and societal change. It has never been more important to provide nonbiased, nonpartisan insight, guidance and advocacy to stakeholders in our field. NEFE remains committed to ensuring all Americans have access to high-quality financial education. Against this backdrop, we are excited to share some of the organization’s achievements in 2024.

This past fall, we hosted our second Financial Education Innovation & Impact Summit dedicated to addressing critical issues in financial education access, quality and impact. The event brought together thought leaders, highlighted our strategic partnerships, and honored excellence through awards focused on Innovation and Impact. The discussions centered on equitable and inclusive financial education—key themes shaping our current and future work.

We reached significant milestones tied to our first formally detailed strategic plan launched in 2019. While NEFE has always been steadfast in its mission to support partners in advancing effective financial education, the strategic plan provided a framework to guide our efforts, including introducing initiatives like the Personal Finance Ecosystem to provide clarity on the factors of well-being and also our work to center equity and inclusion in our approaches. Our research expanded, exploring how financial education shapes resilient Indigenous communities and opinion polling on student loan sentiments and election-related financial issues. The momentum in K-12 financial education continues, with 26 states requiring personal finance coursework for graduation. NEFE remains committed to providing analysis and guidance, including our annual legislative review and forthcoming policy position papers on effective implementation.

We continue to welcome new members to our Board of Trustees and staff, who bring fresh perspectives and expertise to our mission. Our dedicated team remains our most valuable asset, driving meaningful impact in financial education.

Thank you for your continued support as we work toward accessible, effective and inclusive financial education for all.

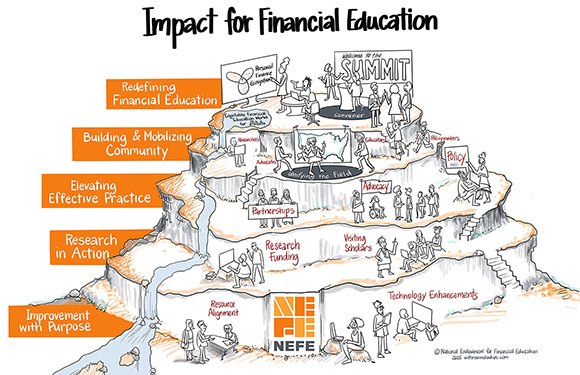

The end of 2024 also marked the close of NEFE’s 2019-2024 Strategic Plan: Impact for Financial Education, the first formal roadmap for understanding and improving the Personal Finance Ecosystem.

During that time, we aligned our resources and retired several legacy initiatives to focus more on understanding the impact of knowledge and behavior influencers, supporting actionable research and engaging thought leaders to shape a forward-thinking agenda. By promoting best practices and knowledge sharing, our focus was to enhance financial education and address systemic factors that affect financial well-being.

We are proud to celebrate the achievements of our five strategic goals, highlight key initiatives and share our progress as we work toward a future where everyone has the knowledge, confidence and opportunity to live their best financial life.

Chair Emeritus, Atlanta, GA

2025 Chair, Columbus, OH

2025 Vice Chair, Durham, NC

Trustee, San Francisco, CA

Trustee, New York, NY

Chair Emeritus, Rye, NY

Trustee, Irvine, CA

Trustee, Long Beach, CA

Trustee, Palm Beach, FL

Trustee, San Francisco, CA

Trustee, Ithaca, NY

Trustee, Tampa, FL

Trustee, Orange, CA

Trustee, New York, NY

President and Chief Executive Officer, Denver, CO

President and Chief Executive Officer, Denver, CO

Treasurer and Chief Financial Officer

Chief of Staff

Senior Vice President, Research and Policy

Senior Vice President, Equity and Engagement

Managing Director, Research

Managing Director, Insights

Manager, Administration

Director, Research

Senior Manager, Policy and Advocacy

Manager, Office Operations

Manager, Policy and Advocacy

Director, Strategic Partnerships

Senior Director, Operations

Managing Director, Media and Communications

Director, Thought Leadership Initiatives

Senior Manager, Technology

Managing Director, Marketing

Manager, Grants and Research Projects

Senior Manager, Marketing

Senior Manager, Human Resources

Senior Manager, Communications

Director, Business Projects

Managing Director, Policy and Advocacy

Manager, Operations Support

Managing Director, Marketing and Engagement

Manager, Marketing

Manager, Grants and Research Projects

Manager, Research

Senior Director and Controller, Accounting

Senior Manager, Marketing

NEFE does not raise revenue through the sale of products or services. Growth of the endowment occurs through the investment of assets. NEFE is a private operating foundation and subject to annual minimum spending rules by the Internal Revenue Service. All charitable activities, apart from research grants, count toward the minimum spending requirement.

2024 Minimum Required Spend

2024 Total Actual Spend

Estimates as of 12/31/24. See 990PF for finalized numbers.

Market Value of NEFE Endowment

NEFE held its second Financial Education Innovation & Impact (FEI&I) Summit in October 2024, bringing together researchers, advocates, policymakers, educators and thought leaders from across industries and disciplines for critical conversations on financial education and wellness.

Over 280 registrants (a 140% increase compared to the 2022 Summit) gathered in Denver for learning, networking, presentations from renowned thought leaders and discussions guided by the principles of quality, access and impact.

“We take great pride in celebrating the outstanding achievements that drive our field forward. It is our privilege to showcase the remarkable work being done as it inspires future efforts in effective financial education. Recognizing the winners of the Innovation Awards and the Impact Awards is one of my favorite parts of our FEI&I Summit.

-- Billy Hensley, president and CEO of NEFE

NEFE’s Innovation Award recognizes organizations and individuals who exhibit leading-edge work and groundbreaking progress in financial education. Recipients move the field forward in exciting, transformative ways and exemplify originality and a forward-thinking vision. The 2024 recipients of the NEFE Innovation Award are the Financial Education Public-Private Partnership and the FLY Initiative.

“Receiving the NEFE Innovation Award is an incredible honor and I am deeply humbled to be recognized for work that is so close to my heart. Financial education has the power to change lives and the greatest reward is seeing the hope it brings to individuals and communities. This acknowledgment by NEFE is a testament to the impact we are making and I am beyond grateful to be living in my purpose, helping others build a brighter, more empowered future.

-- Marcy Reyes, MSF, AFC®, FLY Initiative founder and CEO

NEFE’s Impact Award recognizes organizations and individuals who seek meaningful change, significant achievement and measurable impact in financial education. Recipients demonstrate a body of work that is foundational for the field by contributing to its momentum, shaping best practices and advancing financial well-being. The 2024 winners are John Pelletier from the Center for Financial Literacy at Champlain College (VT) and Dr. Julie Heath from the Alpaugh Family Economic Center at the University of Cincinnati.

“NEFE is the most respected organization in this space, providing leadership, context and courage in how we think about and address financial education. NEFE has always been my north star in terms of integrity and dedication to the cause, and I am very grateful for this recognition from such an iconic organization.

-- Dr. Julie Heath, Alpaugh Family Economic Center at the University of Cincinnati director emerita

The Personal Finance Ecosystem (PFE) is a framework developed by NEFE to help better understand the individual and systemic factors that influence financial well-being. In 2024, NEFE enhanced the research-informed vision for translating the PFE into an engaging online learning experience, including:

2024 speaking engagements focused on the Personal Finance Ecosystem

The partnership with the ACA focuses on rural, first-generation college students. Seven colleges executed tailored financial education interventions throughout 2024, including embedded learning in a required quantitative literacy course for first-year students to hiring and training peer mentors. Assessments conducted at the start and end of the semester showed positive impacts on students’ financial well-being, knowledge and skills. NEFE shared interim results in a report for the 2023-2024 academic year.

The partnership with CCCS aims to improve financial education for community college students who are often older, more racially diverse, more likely to study and work part-time compared to traditional four-year undergraduates. CCCS launched its online Colorado Skills Institute, offering an eight-module micro-credential program free to all students and staff. The modules are self-paced to make them more adaptable and flexible for community college students. To supplement system-wide access to the micro-credential, a majority of the community colleges in the state have developed financial wellness programming on their campus.

NEFE values collaboration with mission-aligned organizations to build, deliver and promote programs, initiatives and research focused on financial well-being. Our diverse partnerships span social services, education, research and media organizations.

2024 Speaking Engagements

2024 Technical Requests

The policy landscape around diversity, equity and inclusion (DEI) efforts is rapidly shifting. NEFE closely monitors federal and state-level policy changes that impact financial education legislation. Understanding how financial education and DEI policies intersect is central to positioning culturally responsive and equitable financial education approaches as states introduce, develop or refine curriculum requirements.

Effective financial education is equitable, inclusive and reflects intentional approaches that advance financial well-being for all. NEFE continues to deepen its understanding of research-informed practices that center one’s experiences, identity, environment and cultural frameworks as fundamental to improving access, quality and the impact of our work.

Several initiatives in 2024 were instrumental in helping NEFE continue to enhance pathways and approaches to advance equitable financial education. These efforts included:

Through our research-informed work, NEFE’s Visiting Scholar series elevates voices of traditionally marginalized and oppressed communities. In 2024, Stephanie Cote completed a seven-part research project on financial education and the Native American experience. Her work elevated our understanding of Indigenous Americans, including a history of colonialization, current considerations and future recommendations.

Through our research-informed work, NEFE’s Visiting Scholar series elevates voices of traditionally marginalized and oppressed communities. In 2024, Stephanie Cote completed a seven-part research project on financial education and the Native American experience. Her work elevated our understanding of Indigenous Americans, including a history of colonialization, current considerations and future recommendations.

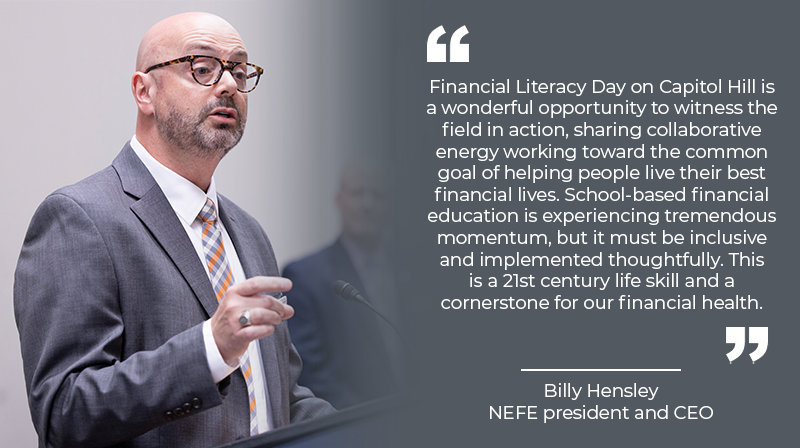

This event, co-hosted with the Jump$tart Coalition for Personal Financial Literacy, featured honorary co-hosts Senator Tim Scott (R-SC) and Senator Jack Reed (D-RI) to bring attention to financial education at the congressional level. The event drew over 250 advocates, educators, practitioners and policymakers of various backgrounds and specializations.

Emma Donahue, Raven Newberry and Billy Hensley presented at the National Association of State Treasurers on how using federal datasets for state-level insights to state treasury financial education leaders.

Raven Newberry, Hunter Field and Emma Donahue presented an overview of the K-12 financial education requirements landscape to the Association for Financial Counseling and Planning Education community. Our team participated in a discussion on how Accredited Financial Counselors can get more involved in advocating for issues they care about.

Beth Bean and Emma Donahue presented an overview of the K-12 financial education requirements landscape and how the teachers, thought leaders and coalition members can get involved at the Jump$tart Coalition for Personal Financial Literacy Partners Meeting.

NEFE’s legislative review for 2024 analyzed key themes of legislative activity in the K-12 financial education requirement space, including wins and setbacks. This was followed by a webinar outlining recent states that passed legislation, as well as new data on the implementation phase in different states.

As of 2024, 26 states have passed legislation for a financial education requirement. Learn more about which states are implementing policies using the Financial Education Policy Tracker.

NEFE refielded its 2023 student loan poll to assess the impact of the student loan repayment pause ending on individuals who currently have or have had student debt. The two polls compared perceptions before the payment pause ended and the realities one year later. This poll was the subject of a national satellite media tour with Billy Hensley among more than 30 television, radio and online news outlets.

Among respondents whose loans have not been paid off or forgiven, 74% say they have had to make budgetary adjustments to make their payments with 28% cutting up to $500 from their monthly budgets, 21% cutting between $501 and $1,000, 10% cutting more than $1,000 and 15% needing to make significant changes but do not know how much.

In October, NEFE polled U.S. adults on their financial well-being prior to the November elections, recognizing the ballot box is a way many share opinions on economic change.

Nearly half (47%) of respondents felt the election results would impact their finances, with 40% saying it may have an impact. Respondents cited their top financial stressors as high prices for essential goods (22%), insufficient income (17%) and rent or mortgage payments (16%).

Led by Dr. Christine Mulhern, the RAND team completed their project entitled "Statewide Implementation of Financial Education in Nevada Schools." The research evaluated the implementation and efficacy of state-required financial education. The grant aided in preparing interviews, focus groups and survey questions to collect qualitative data among Nevada school educators. This research addresses the need for building awareness of financial literacy curriculum with legislators and key policy stakeholders.

Led by Dr. Christine Mulhern, the RAND team completed their project entitled "Statewide Implementation of Financial Education in Nevada Schools." The research evaluated the implementation and efficacy of state-required financial education. The grant aided in preparing interviews, focus groups and survey questions to collect qualitative data among Nevada school educators. This research addresses the need for building awareness of financial literacy curriculum with legislators and key policy stakeholders.

Morgan State University received $138,000 for “Creating Identity Responsive Financial Education.” The researchers will produce a model of financial identity for Black Americans with guidance for providing identity-responsive financial education for Black students.

Morgan State University received $138,000 for “Creating Identity Responsive Financial Education.” The researchers will produce a model of financial identity for Black Americans with guidance for providing identity-responsive financial education for Black students.

“We are thrilled about the NEFE grant because of their dedication to advancing equity in financial education. With NEFE’s support and collaboration, we will develop a model for financial identity that demonstrates how the field can construct equitable frameworks that reflect the diverse experiences and needs of individuals across the United States.

-- Whitney Johnson, Ph.D., associate professor of mathematics education

UCLA received $55,000 for “The Power of Second Sight: Measuring the Impact of Political Financial Education on Inequality,” which seeks to understand if political education and class consciousness can act as a form of financial literacy for marginalized populations.

UCLA received $55,000 for “The Power of Second Sight: Measuring the Impact of Political Financial Education on Inequality,” which seeks to understand if political education and class consciousness can act as a form of financial literacy for marginalized populations.

“I’m thrilled to partner with NEFE on this critical project. In a financial landscape rife with disinformation and predatory practices, our goal is to explore whether political education can serve as powerful tools of financial literacy for marginalized groups. With NEFE’s support, we hope to uncover strategies that equip communities to protect and defend themselves in an inequitable system.

-- Jasmine Hill, Ph.D., assistant professor of public policy and sociology

Education Northwest received $100,000 for “The Relationship Between Financial Literacy and College Basic Needs Insecurity.” The funding will be used to examine the 23% of U.S. college undergraduates who experience food insecurity and the 8% of U.S. college undergraduates who experience homelessness. The project, led by Sara Goldrick-Rab, Ph.D., senior fellow at Education Northwest, explores the hypotheses that strengthening students’ financial knowledge might mitigate the effects of poverty and promote degree completion.

Education Northwest received $100,000 for “The Relationship Between Financial Literacy and College Basic Needs Insecurity.” The funding will be used to examine the 23% of U.S. college undergraduates who experience food insecurity and the 8% of U.S. college undergraduates who experience homelessness. The project, led by Sara Goldrick-Rab, Ph.D., senior fellow at Education Northwest, explores the hypotheses that strengthening students’ financial knowledge might mitigate the effects of poverty and promote degree completion.

NEFE offers annual research funding to advance projects with the potential to advance effective financial education. Learn more about our funding priorities.

This project was a collaboration with Northern Kentucky University (NKU) on a comprehensive K-12 standardized financial education assessment to provide educators with a tool to evaluate student learning in alignment with the latest educational standards set by the Council for Economic Education and the Jump$tart Coalition for Personal Financial Literacy. The assessment covers different topics and is divided into three levels (elementary, middle and high school), with each level having its own set of learning outcomes. NKU’s research team piloted this work 1,400 students in Kentucky and Nebraska, providing preliminary data on student knowledge in these states.

NEFE’s two-year collaborative work on scale validation continued in 2024, addressing the lack of rigorous testing and validation of some of the most utilized survey assessments in the financial services industry. A subject matter expert panel, in collaboration with the NEFE Research team, created a consensus paper with recommendations for strengthening scale validation work in the field, which will culminate in a special issue in the Journal of Family and Economic Issues. Read more on the Scale Validation Project.

NEFE launched a Research Advisory Council consisting of nine members, including financial educators, leading researchers, financial security advocates and practitioners. The Council’s goal is to provide NEFE with direct access to the members’ unique experiences and perspectives. The Council met four times in 2024, including an in-person gathering following the FEI&I Summit. The Council is a critical pathway for NEFE to stay connected to experts in our field.

In 2024, NEFE collaborated with executive editors from two journals to facilitate special issues. One issue, based on our scale validation project, will be published in the Journal of Family and Economic Issues, focusing on measurement limitations in the financial services sector. The other initiative, with the Journal of Financial Counseling and Planning, focuses on equity and diversity in financial education and is slated for publication in late 2025 or early 2026. Both special issues will be open access, with fees covered by NEFE.

2024 Peer Reviewed Citations

Peer Reviewed Citations Since 2006

NEFE disseminates research, poll data and provides support to journalists in their consumer finance reporting. NEFE is frequently cited in media outlets across the country.

2024 Total Media Mentions

Overall Coverage in Top-Tier* Media Outlets

*Top-tier = outlets with national reach, syndication of content and/or have reached over 500k impressions