Savings and Paying Bills Among Top Financial Concerns

DENVER—According to a new survey released by the National Endowment for Financial Education® (NEFE®), nearly nine in 10 (88 percent) Americans say the COVID-19 crisis is causing financial stress.

More than half (54 percent) of Americans say among the top five things causing the most financial stress right now is not having enough saved (41 percent for emergency savings; 23 percent for retirement), while almost half (48 percent) of individuals say they are worried about their ability to pay bills (28 percent for both housing payments and utilities; 19 percent for health care bills). With recent news from the Department of Labor that one in 10 Americans is now seeking unemployment benefits, it’s clear that worry about job security could be escalating. The NEFE survey finds that 39 percent of employed* Americans say stress over job security is among their top financial concerns. The survey was conducted online by The Harris Poll, on behalf of NEFE, from April 7-9, 2020, among more than 2,000 U.S. adults.

What Concerns Are Causing Americans the Most financial Stress?

“This outbreak is an unprecedented event and it’s understandable that Americans from all income levels, ethnicities and regions are concerned about their financial situation and are taking steps to adjust to their new normal,” says Billy Hensley, Ph.D., president and CEO of Denver-based NEFE. “While the strain from this crisis is immense, there should be focus on protecting our financial well-being in addition to our physical health and the safety of our families.”

According to the survey, 29 percent of Americans say they are concerned about income fluctuations (e.g., loss of income, reduced income), and 25 percent say they are worried about financial market volatility (e.g. stock market losses).

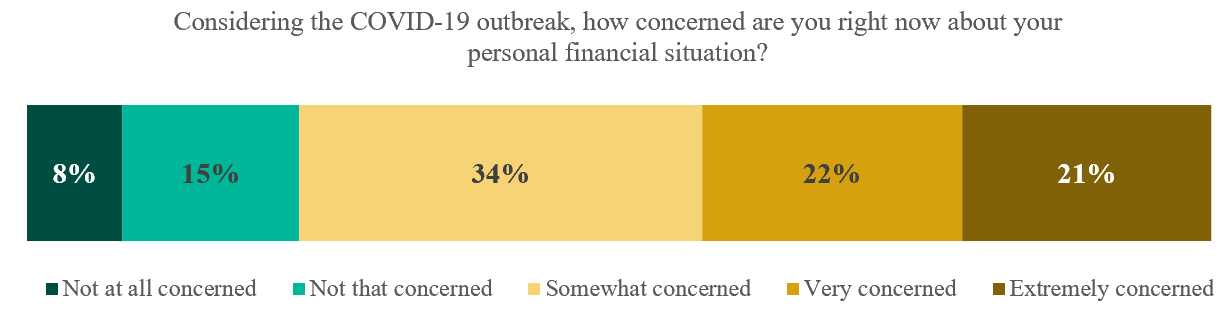

Interestingly, the level of concern over personal finances due to COVID-19 is consistent for those on opposite ends of the income spectrum. Nearly eight in 10 (79 percent) of Americans with household incomes (HHI) less than $50,000 per year say they are at least somewhat concerned about their financial difficulties, compared to the same percentage (79 percent) for those with HHI over $100,000 per year. Those within the middle-income brackets are somewhat less concerned (73 percent for those with an annual HHI of $50,000-$100,000).

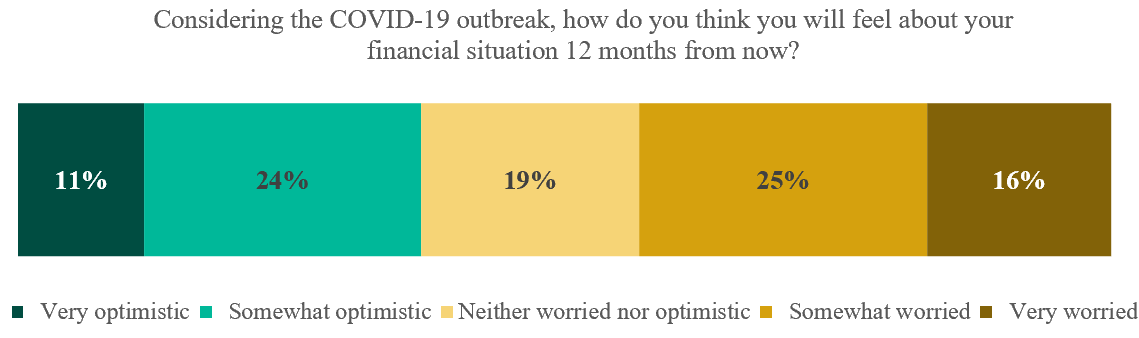

How Concerned are Americans about Future Financial Issues?

The survey also finds that the outlook for personal finances a year from now is proportionately low. Over two in five (41 percent) of Americans say they will feel “very/somewhat worried” about their financial situation 12 months from now, compared to one in three (34 percent) who will feel “very/somewhat optimistic” about their financial situation a year from now.

“Historically, Americans are very optimistic about the future despite their current circumstance. These data seem to be more pessimistic than other studies like this,” says Hensley.

While concern about money is clear during this health crisis, a majority (75 percent) of Americans say they have taken steps to adjust their personal finances due to the COVID-19 outbreak. Over two in five (42 percent) note they have cut monthly expenses, 26 percent are putting off major financial decisions (e.g., buying/selling a home, making a major purchase), and 22 percent have increased contributions toward savings (e.g., emergency, retirement). Just 17 percent say they have tapped into an emergency savings with 6 percent saying they have borrowed against retirement savings. Additionally, only 12 percent say they plan to defer bill/debt payments and 10 percent say they have taken on more credit card debt.

Overall, the groups who note the greatest level of concern about their personal financial situation are:

- Income: Individuals with annual HHI below $50,000 or above $100,000

- Employment: Individuals who are currently employed (81 percent vs. 72 percent unemployed)

- Parents: Individuals who have children under age 18 (83 percent vs. 74 percent without children)

- Property status: Individuals who rent (81 percent) vs. own a home (76 percent)

- Age: Individuals between 18-64 years of age (81 percent are significantly more likely to be concerned than individuals age 65 or older 62 percent)

“We are witnessing a pivot within our community of financial educators and advocates to keep services available to teachers and learners, as well as developing plans to respond to the millions who will need financial education as they work toward recovery,” notes Hensley. “But efforts on the home front are important too. Children are paying attention to what’s going on in the household so it’s essential during this crisis to have regular conversations about how your family specifically is being impacted. Parents should be as transparent, and calm, as possible.”

Read more about the COVID-19 survey.

Survey Methodology

This survey was conducted online within the U.S. by The Harris Poll on behalf of the National Endowment for Financial Education between April 7-9, 2020, among 2,018 adults ages 18 and older. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. Please contact for complete survey methodology, including weighting variables.