DENVER—The National Endowment for Financial Education® (NEFE®) continues to monitor the pulse of Americans by polling on financial well-being indicators at key moments in time since the COVID-19 crisis began. NEFE’s recent survey, commissioned at the end of June 2021 and conducted online by The Harris Poll, is the latest in a series spanning a 16-month period that overlaps the pandemic in the U.S. While not fully comparative due to adjustments in some questions, the timing of the polls (June 2021, Dec. 2020, Sept. 2020 and April 2020) mirror times in which many Americans were weighing their level of financial stress and making important decisions about their finances, directly or indirectly related to the pandemic.

“It is our duty as champions of effective financial education to identify how Americans are feeling about their economic present and future at key moments in time. Our polling supplements the other work we do to assist policymakers and practitioners in our field,” says Billy Hensley, Ph.D., president and CEO of NEFE. “These latest results, combined with trends identified in previous polling, highlight the need for more diligent work to aid the plight of those most in need of financial well-being resources and interventions, including financial education.”

Overall, recent polling indicates more Americans are feeling better about the quality of their financial life now, relative to their expectations, compared to the end of 2020. The proportion of Americans reporting feeling that their financial life is “worse than [they] expected it to be” decreased from 32 percent in Dec. 2020 to 23 percent in June 2021, while the proportion reporting “better than what [they] expected it to be” increased from 15 percent in Dec. 2020 to 27 percent in June 2021. In June 2021, over three quarters (77 percent) of Americans said the quality of their financial life is what they expected or better.

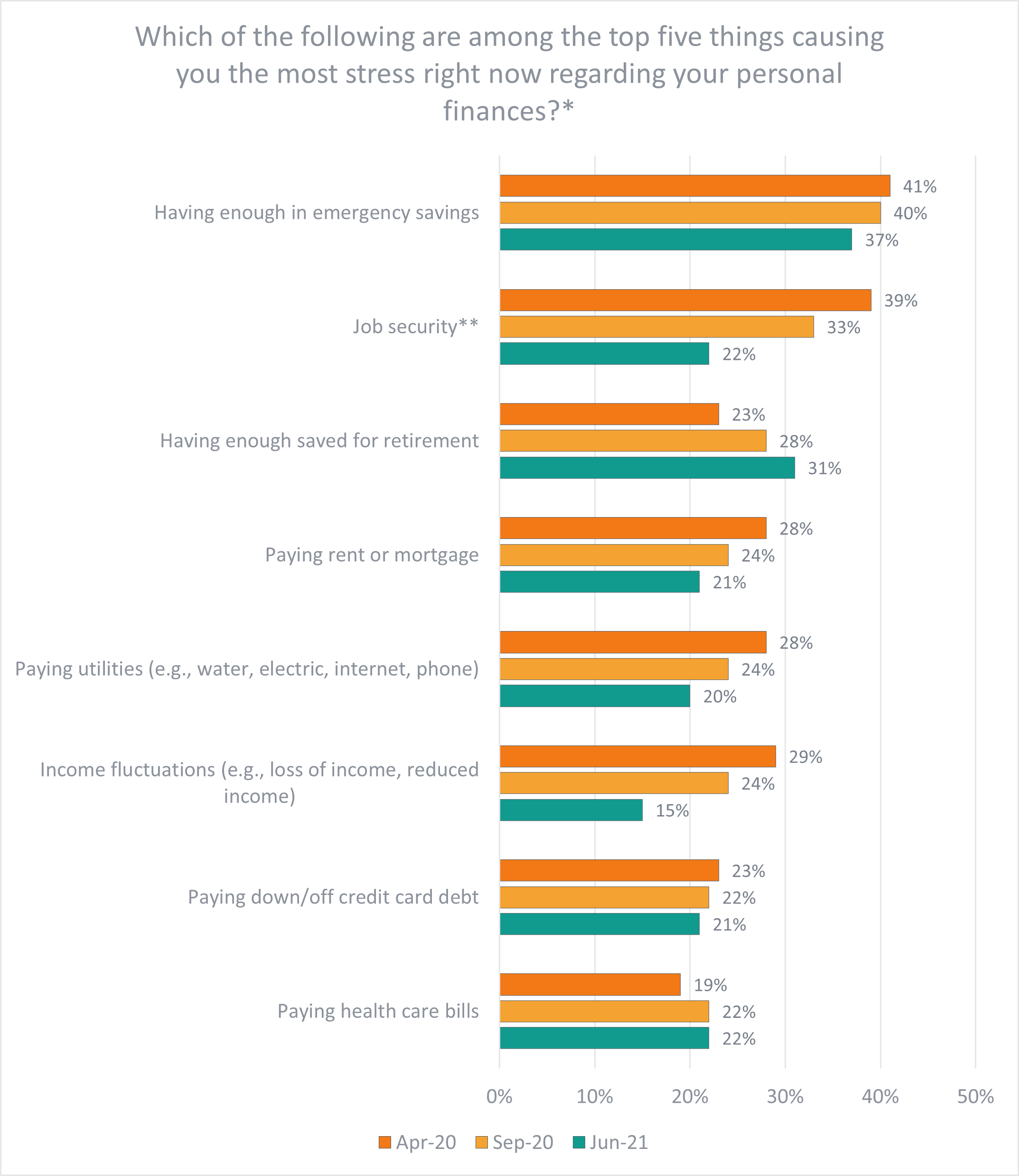

Through further analysis, 85 percent of Americans did confirm some part of their personal finances is causing them stress right now, with the most common concerns being “having enough in emergency savings” (37 percent), “having enough saved for retirement” (31 percent), “paying health care bills” (22 percent), “job security” (among those employed, 22 percent), “paying off/down credit card debt” (21 percent) and “paying rent or mortgage” (21 percent). After combining several stressors related to savings and paying bills, 56 percent report that having enough saved is a top stressor and 44 percent report that paying bills is a top stressor. However, among these top stressors, the only financial stressor with an increase from previous polls was having enough saved for retirement.

*Figure presents the top five stressors for each administration. There are eight stressors since the top five stressors varied per administration. In the April 2020 and September 2020 administration, the question started with “Considering the COVID-19 outbreak,” which was omitted from the June 2021 administration cycle; for this reason, use caution when comparing across survey administration cycles. **This number reflects the total proportion of respondents who indicate that they are currently employed.

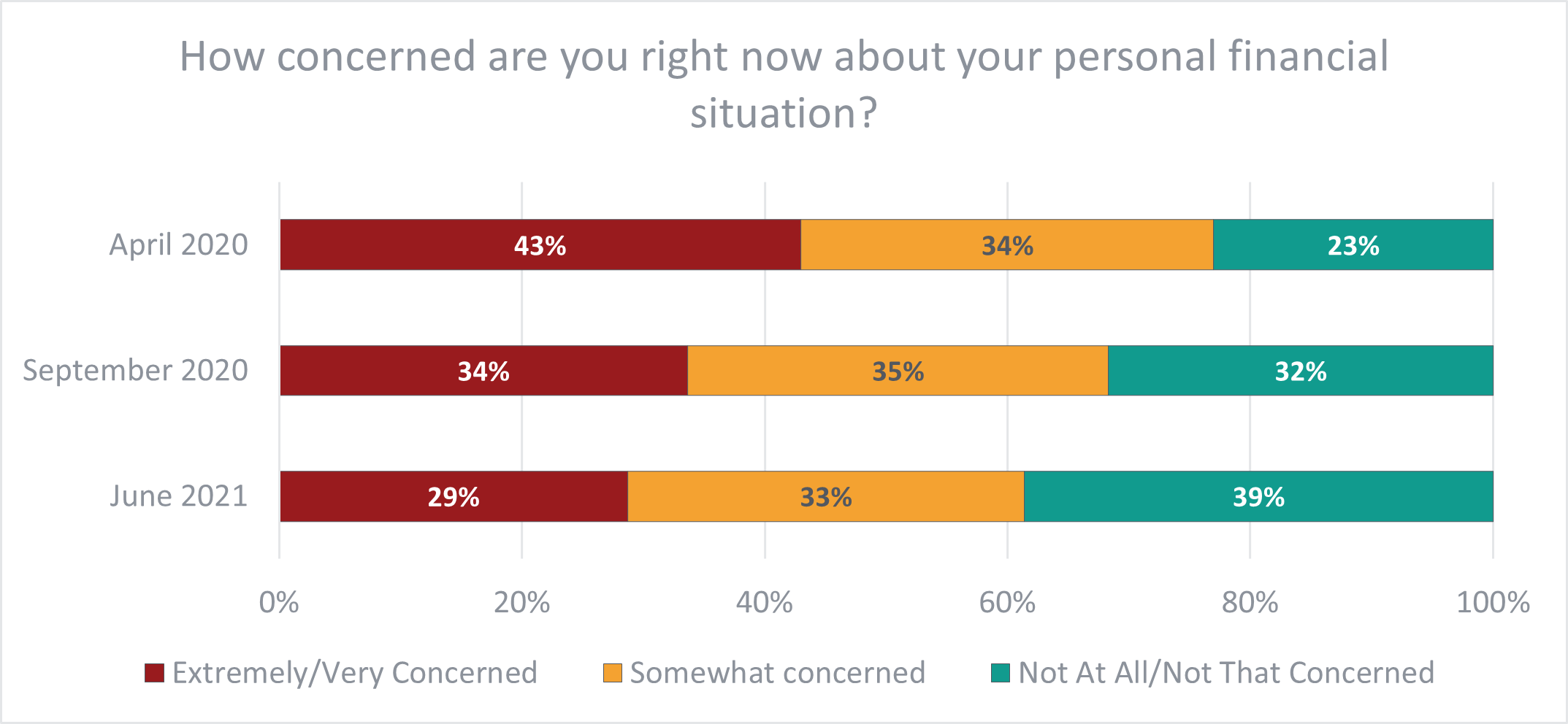

When asked about how concerned they are right now about their personal financial situation, a larger proportion of Americans are now reporting “not at all/not that concerned” than in our 2020 polls, and a smaller proportion are reporting “extremely/very concerned” while “somewhat concerned” remains relatively constant.

In the April 2020 and September 2020 administration, the question started with “Considering the COVID-19 outbreak,” which was omitted from the June 2021 administration cycle; for this reason, use caution when comparing across survey administration cycles.

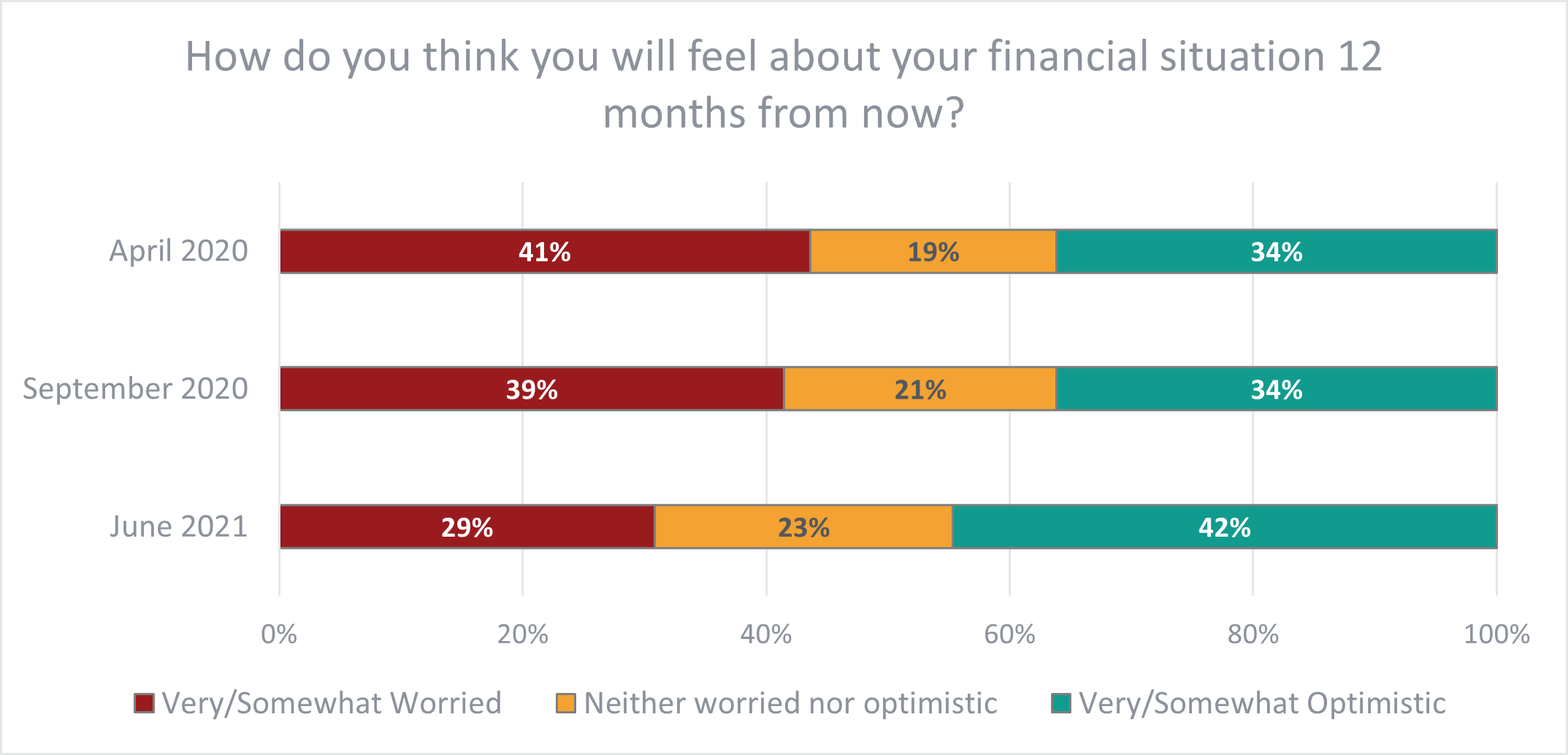

When individuals consider their future financial situation, over one quarter (29 percent) think they will feel “very/somewhat worried” about their financial situation 12 months from now, while over two in five (42 percent) think they will feel “very/somewhat optimistic.”

Other highlights from the recent poll include:

- Seven in 10 (70 percent) have made financial adjustments due to the COVID-19 outbreak, such as cutting monthly expenses (29 percent) and putting off major financial decisions (20 percent).

- More than one quarter (27 percent) are increasing contributions to their emergency/retirement savings, other savings or investments due to the pandemic, while 21 percent are tapping into emergency savings or borrowing against retirement savings.

- Nearly half (47 percent) admit to living paycheck to paycheck, compared to 52 percent in December 2020.

- Over one in 10 (14 percent) are looking for a new job or are seeking additional work due to the pandemic.

- Nearly one in 10 (9 percent) plan to defer bill/debt payments and 13 percent have taken on more credit card debt, due to the COVID-19 outbreak.

- Over two in five (44 percent) Americans have provided monetary/non-monetary assistance to family or friends due to the COVID-19 outbreak, with 17 percent saying the non-monetary support is ongoing and 13 percent saying the monetary support is ongoing. Among those providing assistance, 83 percent say it has caused at least some strain on their own finances.

- Nearly one third (31 percent) of Americans say they have received monetary/non-monetary assistance from friends or family due to the COVID-19 outbreak.

Additional analysis of the June 2021 poll’s demographic breakdown finds:

- Hispanics (60 percent) and Black non-Hispanic Americans (51 percent) are more likely to say they have provided monetary/non-monetary assistance than White non-Hispanic Americans (38 percent). The difference is most notable in the provision of one-time, non-monetary assistance (24 percent each of Hispanics and Black non-Hispanic Americans vs. 12% of White non-Hispanic).

- Nearly six in 10 (59 percent) Americans with children under age 18 living in the household were likely to report providing monetary/non-monetary assistance, compared to 35 percent of Americans without children under age 18 in the household.

“This poll provides an interesting snapshot due to both its results and timing. It came as the economy was steadily improving, before mainstream discussions of COVID-19 variants, the need for additional virus prevention policies and decisions on whether the eviction moratorium was still needed. Americans were potentially the most optimistic they had been in over a year about the direction of their financial well-being, and we were able to capture that sentiment,” Hensley continues.

Learn more about the June 2021 financial well-being poll results and other recent polls.

NEFE’s continued consumer polling is a necessary project as the organization transitions to an institute model that will assist practitioners, advocates and policymakers. This transition includes ending management of its financial education platforms, hosting a series of high-impact policy-focused convenings with industry stakeholders and hiring Beth Bean, Ph.D., as senior vice president of research and impact to spearhead NEFE’s organizational transition.

Learn more about NEFE’s evolving strategy.

Survey Methodology

The June 2021 survey was conducted online within the U.S. by The Harris Poll on behalf of NEFE between June 28-30, 2021, among 2,073 adults ages 18 and older. The December 2020 survey was conducted online within the U.S. by The Harris Poll on behalf of NEFE between December 10-14, 2020, among 2,064 adults ages 18 and older. The September 2020 survey was conducted online within the U.S. by The Harris Poll on behalf of NEFE between September 14-16, 2020, among 2,049 adults ages 18 and older. The April 2020 survey was conducted online within the U.S. by The Harris Poll on behalf of NEFE between April 7-9, 2020, among 2,018 adults ages 18 and older. Results were weighted for age within gender, region, race/ethnicity, income and education where necessary to align them with their actual proportions in the population. Propensity score weighting was also used to adjust for respondents’ propensity to be online. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated.