The Latest

Financial Education in the Context of Systemic Barriers

April 02, 2025

How can financial education address systemic barriers and historical trauma in Native communities? Discover insights and solutions in NEFE’s latest reflection

NEFE Announces New Addition to Board of Trustees

March 24, 2025

NEFE welcomes new leadership to its Board of Trustees, bringing fresh perspectives to advance financial education and equity. Meet the newest members.

Morgan State University, UCLA Receive Grant Funding For Equity Research In Financial Education

December 12, 2024

NEFE empowers equity-focused financial education through groundbreaking research grants awarded to Morgan State University and UCLA

Poll: 47% of U.S. Adults Believe Personal Finances Will be Impacted by 2024 Election Results

October 25, 2024

New NEFE poll shows high price of essential goods, insufficient income, and home payment as top sources of stress leading into 2024 election.

Financial Education Innovation & Impact Summit Explores, Shapes New Trends For The Field

October 24, 2024

NEFE President and CEO Billy Hensley describes the 2024 Summit in one word: “Energy”—bringing together top minds to tackle the future of financial education.

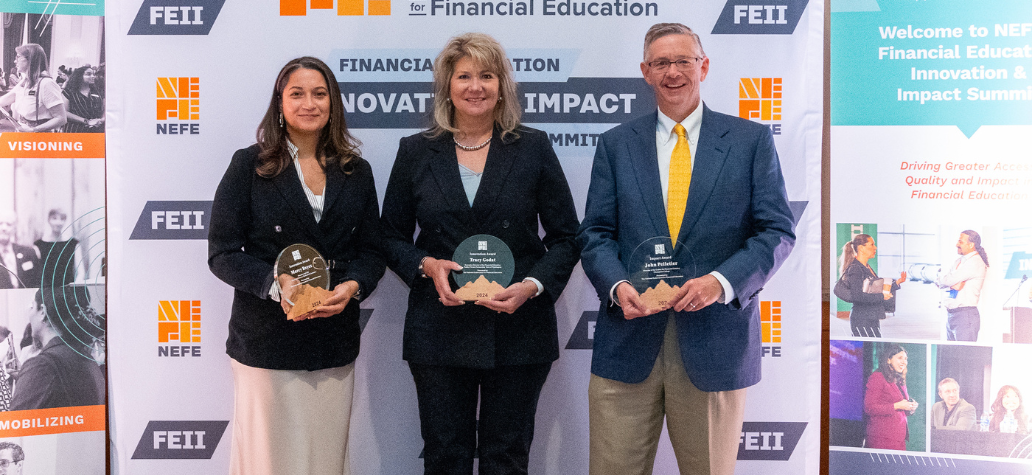

NEFE Names Newest Innovation Award, Impact Award Recipients

October 14, 2024

At the 2024 FEI&I Summit, NEFE recognized leaders driving financial education forward with its Innovation and Impact Awards. Discover the recipients making a difference.

Poll: 3 In 4 Student Loan Holders Have Had To Make Budgetary Adjustments Since End Of Loan Payment Pause

September 30, 2024

Discover how the latest NEFE poll illuminates the financial adjustments borrowers made following the end of the student loan payment pause.

Respect Legislative Intent with Youth Financial Education Requirements

August 19, 2024

Are high schools giving students and educators the tools they need? Dive into the discussion of the importance of implementing stand-alone financial education courses in high schools to ensure students receive comprehensive and equitable financial literacy.

Passing Legislation Is Just the Beginning: A 2024 Legislative Review of K-12 Financial Education Requirements

August 16, 2024

Our 2024 legislative review reveals key state-by-state progress and setbacks in financial literacy requirements around the United States.

New Report Explores Financial Education Curriculum Implementation Process for States

August 12, 2024

Discover the key challenges and solutions in implementing state financial education mandates with insights from a comprehensive NEFE-funded study on Nevada's approach.

The Importance of Equity in Financial Education

August 07, 2024

Discover Dr. Michelle Samuels-Jones' insights on the importance of equitable financial education and its impact on marginalized communities.

Partnership and Progress – 2024 Financial Literacy Day on Capitol Hill

July 23, 2024

Discover how advocates and policymakers are shaping the future of financial education at the 2024 Financial Literacy Day on Capitol Hill.

Financial Literacy Month 2024: A Comprehensive Focus on Financial Capability

April 30, 2024

Embark on an exploration of financial capability in 2024 with NEFE. From bipartisan proclamations to groundbreaking research, discover the latest initiatives shaping financial capability.

NEFE Research Team Announces Distribution Strategy on Comprehensive Scale Validation Project

April 18, 2024

Explore NEFE’s scale validation project

New Opinion Poll of U.S. Adults Contrast Current and Future Concerns Regarding Financial Well-Being

April 04, 2024

Dive into the latest NEFE poll to uncover the financial sentiments of U.S. adults—optimism tempered with concerns about the future. Discover more now!

Financial Education Research Projects Exploring Underserved Communities Receive Funding

April 03, 2024

Dive into NEFE's groundbreaking research, addressing college food insecurity and wealth gaps. Join the discussion at the upcoming Financial Education and Innovation Summit.

NEFE Appoints New Members to Board of Trustees

March 08, 2024

NEFE welcomes Nancy Kim-Yun and Beth Lesen to its 16-member Board of Trustees. Meet the new faces driving change and innovation.

Poll Analysis: Native Community Members Who Experience Bias Report Lower Quality of Financial Life

March 08, 2024

Explore how bias affects Indigenous financial well-being. Insights reveal barriers hindering flourishing & importance of inclusion.

RTDNA, NEFE Partner on Personal Finance Reporting Resource

February 06, 2024

Uncover the power of Finance 411: RTDNA & NEFE's dynamic partnership, helping delivering impactful personal finance reporting.

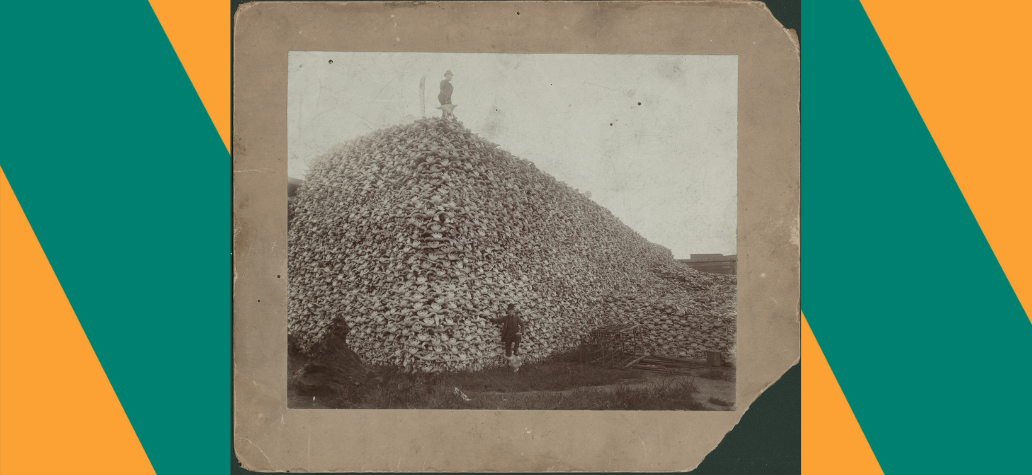

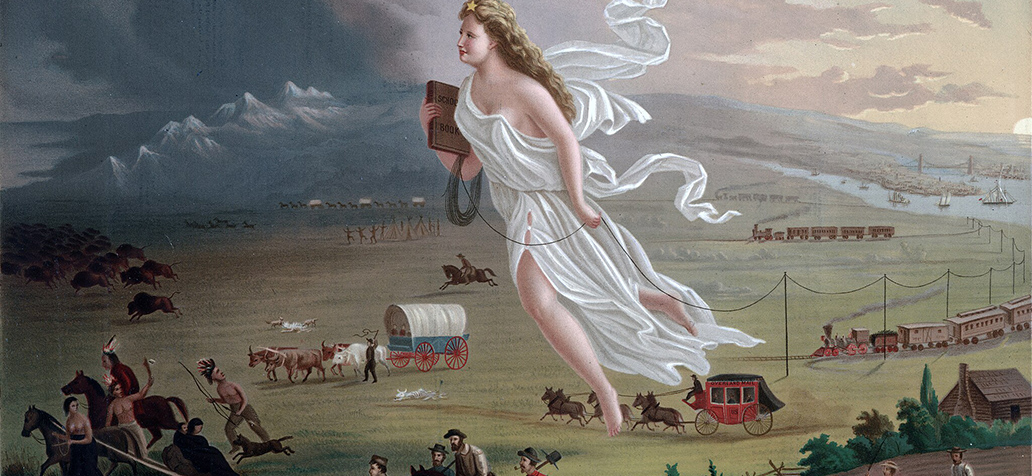

In Context: Historic Injustice and Financial Education in Indigenous Communities

January 23, 2024

Delve into the profound examination of historic injustices and financial education within Indigenous communities. NEFE, led by Stephanie Cote, unravels critical narratives, challenging conventional approaches. Join us in reshaping effective financial education with cultural sensitivity.

Trends in Innovation and Impact

January 16, 2024

NEFE's 2022 Summit introduced key principles—Access, Quality, and Impact. As we gear up for this year's Financial Education Innovation & Impact Summit, see an outline for our field for the next several years.

Community and Optimism: Revisiting the 2023 Financial Literacy Day on the Hill

December 04, 2023

Explore the spirit of collaboration at the 2023 Financial Literacy Day on the Hill! NEFE helps organize advocates, policymakers, and educators to champion financial education for a brighter financial future.

Poll: One-third of Native Community Members Encountered Bias, Exclusion From the Financial Services Sector

November 17, 2023

Unlock financial insights: NEFE's poll finds that one-third of Native community members face bias and exclusion in the financial services sector, double the rate of the general adult population.

Community Reinvestment Act Reforms: A Powerful Tool Against Racial Discrimination in Finance

October 30, 2023

Explore how recent reforms to the CRA tackle racial discrimination in finance, promoting inclusivity and better address today’s challenges.

Higher Education Institutions In Oregon, Alabama Receive Grant Funding For Financial Education Research

October 11, 2023

Unlocking Financial Wisdom: NEFE Awards Grants to Lewis and Clark College, University of Alabama for Innovative Research in Financial Education.

The Road to FinCon: Highlighting the Work of Women

October 05, 2023

Join us on a journey of empowerment and financial well-being with the incredible women of FinCon's Women in Money events!

Stand-alone and Flexible: A 2023 Legislative Review of K-12 Financial Education Requirements

September 25, 2023

Discover the latest in K-12 financial education legislation for 2023 – from standalone courses to teacher requirements, stay ahead with our legislative review

Opinion Poll Data Shows U.S. Adults with Student Loans Worried About the Repayment Pause Ending

September 18, 2023

As the student loan repayment pause nears its end, 83% of borrowers are bracing for financial turbulence. New poll data now!

Reflections From My New Space: Thoughts for Where We Are and What We Can Do

June 27, 2023

Join Michelle Samuels-Jones in her transformative role as NEFE's Senior Director for Equity, empowering underrepresented communities through financial education.

NEFE Welcomes New Senior Director of Equity

June 14, 2023

Introducing Michelle Samuels-Jones, NEFE's new Senior Director of Equity! Join us as we promote inclusive financial education for all.

Consumer Trust, Awareness of Bank Crisis Explored in New Opinion Poll

June 08, 2023

NEFE researched whether awareness of the various bank collapses and failures worldwide in March 2023 impacted consumer trust of the sector in the areas of confidence, faith, ethics and professionalism.

New Poll Examines Consumer Trust in Financial Institutions Following Recent Bank Failures

April 27, 2023

This opinion poll captured exclusive, moment-in-time data on consumer trust in financial institutions and how those sentiments changed following a major, well-publicized crisis in the industry.

How Can Other Fields Help Improve the Impact of Financial Education?

April 24, 2023

Different states have different requirements for financial education. Some are based on needs in the community, while others are based on what the legislature is willing to pass.

Financial Education Innovation & Impact Summit Recap: Our Exploration of Impact

April 21, 2023

A frequent debate, both within and outside the financial well-being sector, is whether financial education “works.” Though, this is generally understood to mean whether financial education can make a measurable difference for those it is delivered to.

Financial Well-being in the Workplace: An Opportunity for Quality

April 20, 2023

Organizations seeking to attract and retain top talent are turning to workplace wellness initiatives as a way to differentiate themselves.

Financial Education Innovation & Impact Summit Recap: Our Exploration of Quality

April 14, 2023

Read our exploration of what constitutes quality financial education and how it can be made more equitable and inclusive. Learn about culturally responsive education, effective legislation, and reducing complexity in this recap of our Financial Education Innovation & Impact Summit.

Physical Health Meets Financial Health: Strategies for Improving Access to Financial Education

April 11, 2023

School-based curriculum has been a successful entry point for widely introducing important financial education concepts, but access to this curriculum has not been available to many important demographics.

Financial Education Innovation & Impact Summit Recap: Our Exploration of Access

April 07, 2023

With less than half of states offering financial education in their public schools, millions of Americans do not have guaranteed access to this essential information.

New Advocacy Resource: Infographics on Financial Education’s Effectiveness

March 21, 2023

We have created three infographics detailing the findings of a joint meta-analysis with the FINRA Foundation to assist those advocating for effective financial education.

New Opinion Poll Explores Emotions Tied to Financial Well-Being

March 03, 2023

Through our first opinion poll of 2023, we explore the intersection between external markers of financial well-being and personal opinions of financial well-being.

In Context: Nonparticipation and Financial Trauma

March 02, 2023

Chloe McKenzie's research on nonparticipation and financial trauma interrogates and tests assumptions that are central to the financial well-being field.

NEFE Welcomes New Board Trustees

January 31, 2023

NEFE welcomes three new professional team members to its 17-member board for 2023, Christine D. Lovely, The Honorable Loretta Sanchez, and Bob Lewis. The NEFE Board named Richard Ketchum 2023 chair, Jason Young vice chair, Colleen Walker chair emeritus.

National Endowment for Financial Education Announces Strategic Partnership Pilot Program

December 20, 2022

We recently committed $2 million for strategic partnerships with the Appalachian College Association and the Colorado Community College System.

NEFE Names First Innovation Award & Impact Award Recipients

December 16, 2022

We named the first Innovation and Impact Award recipients at the inaugural Financial Education Innovation and Impact Summit.

Nationwide Opinion Poll Gauges Financial Decision-Making Confidence and Resources of U.S. Adults

December 06, 2022

We followed up on our recent opinion poll of U.S. adults on types of personal finance decisions made by then exploring the reasons behind the confidence of those decisions.

#FinCon2022: A Retrospective

November 17, 2022

The NEFE staff who attended this year ranged from experienced FinCon participants to newbies. Each of them had a different perspective on their key takeaways.

Confidence in Making Personal Financial Decisions

October 28, 2022

When polled, 83% of U.S. adults admitted to making at least one personal finance-related decision over the past year.

What We’re Reading: Can Social Capital Supplement Financial Education

October 13, 2022

A Brookings research report highlights social capital in relation to bonding versus bridging, families, mentors and peer networks.

Opportunity Leads to Participation, According to Recent Poll on Financial Education Access

September 02, 2022

NEFE has collected new data, further substantiating how individuals with financial education opportunities choose to take it in overwhelming numbers.

NEFE Announces Nearly $500,000 in New Grants

September 01, 2022

Our next grant cycle opens September 15th.

Not all Mandates are Created Equal: a 2022 Legislative Recap

August 29, 2022

Our policy and advocacy team’s analysis of financial education bills and provisions from the most recent legislative session.

In Context: Understanding Racial Trauma's Impact on Financial Literacy

August 16, 2022

We will continue to push for nuanced approaches to financial education: those that situate peoples’ experiences of systemic racism and trauma in context, and those that integrate culturally sensitive teaching.

Understanding Racial Trauma's Impact on Financial Literacy

August 16, 2022

Personal finance programming likely does not capture the multi-layered texture of individual socioeconomic experiences and struggles.

Building (and Rebuilding) Trust in Higher Education: What Community Leaders Face

August 01, 2022

Lack of experience, trust and access to reputable financial funding sources is one of the key issues our Focus on FinEd Podcast Series Addresses.

How Race, Income Play a Role in Discriminatory Practices

July 28, 2022

Of those who have experienced discrimination or bias, a significant number attribute the reason to their identity or personal circumstances.

How LGBTQIA+ Representation Assures Better Data

July 19, 2022

Only when all individuals and families are provided a level playing field free of bias and discrimination will we truly be able to achieve economic stability.

Nearly 1 in 3 LGBTQIA+ Respondents Say They’ve Experienced Discrimination, Bias in Financial Services

June 24, 2022

This is a summary of a survey of 1,050 U.S. adults who identify as members of the LGBTQIA+ community and their interactions with the financial services sector.

Podcast Episode Seven: Recap – A Conversation with Nan Morrison

April 29, 2022

The final episode in our podcast series – a discussion between Dr. Billy Hensley (NEFE) and Nan Morrison (CEE)

Building Momentum for K-12 Financial Education

April 28, 2022

Legislative action, state support and access to trusted resources make a massive difference in leveling equitable financial education access for all students.

Poll: Most Adults Support Financial Education Mandates

April 25, 2022

New Data Highlights Demand During Financial Capability Month

A Reflection on the Research Brief: Financial Education Matters

April 21, 2022

Testing the Effectiveness of Financial Education Across 76 Randomized Experiments

Podcast Episode Six: How can we Better Align Financial Education to Support the Values and Contexts of Diverse Communities?

April 18, 2022

This episode reflects on the importance of placing a diversity, equity and inclusion lens on financial education.

NEFE Announces Research Commitment with RAND Corporation

April 12, 2022

Announcing a grant partnership with the RAND Corporation to research Income Share Agreements (ISAs).

The Importance of State Legislation to Financial Education Access

April 07, 2022

It is crucial that all students have access to financial quality education to equip them with the skills needed to navigate our increasingly complicated economic landscape.

What We’re Reading: Research Continues on Whether Financial Education is Effective

April 05, 2022

We partnered with FINRA and a renowned research team to highlight and amplify recently-published research that explores whether financial education programs affect financial knowledge and behaviors.

Podcast Episode Five: How to Better Support the Needs of Communities in Rural Areas

April 04, 2022

Host Raven Newberry interviews Chrystel Cornelius on how the conversations that happened during the policy convening event can evolve into logical next steps for communities to implement financial education.

Trauma after Trauma – Navigating Financial Anxiety in the Postpartum Period

March 28, 2022

Guest author and BlackFem founder Chloe B. McKenzie explores how financial trauma and financial shame can emerge for new mothers.

Podcast Episode 4: What Research Says is Effective in Financial Education and How Best to Support that with Legislative Dollars

March 24, 2022

Host Raven Newberry interviews Massachusetts’ State Treasurer Deborah Goldberg and Deputy Treasurer Alayna Van Tassel, who provide perspectives of policymakers, examples of initiatives they spearheaded in their state and the benefits of replicating them in other states.

NEFE Poll on Personal Finance Shows How Americans Ended 2021

March 21, 2022

New polling provides a snapshot of how U.S. adults viewed their financial quality of life at the end of 2021.

Podcast Episode 3: Alternative Approaches to Financial Education Mandates and Their Effectiveness

March 07, 2022

Host Raven Newberry interviews Heather Daly and Mike Bobbitt who provide methods, reasoning and examples for what kind of alternate programs can resonate in a community.

Podcast Episode 2: Financial Education’s Role in Equitable Access to Post-Secondary Education

February 14, 2022

Host Raven Newberry interviews Rachel Yanof as they discuss key takeaways and next steps from the policy convening topic: what role might financial education play in equitable access to postsecondary education and training?

Bankrate Names NEFE Best Financial Nonprofit in Social Honors

February 02, 2022

NEFE named Best Financial Nonprofit for bringing financial awareness and education to the masses.

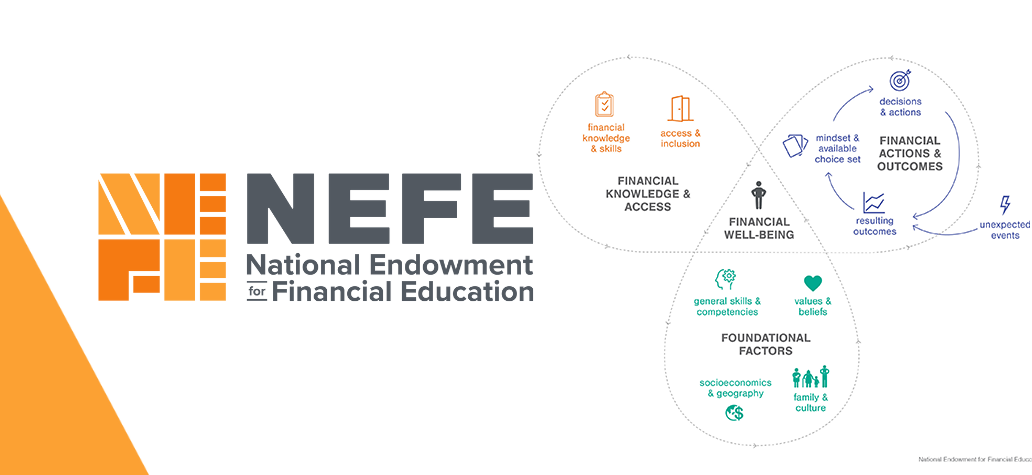

NEFE Updates Personal Finance Ecosystem With New Design; Focus on Inclusion

January 31, 2022

NEFE has updated its Personal Finance Ecosystem, a research-informed framework to help understand the many factors that comprise and influence an individual’s financial well-being.

NEFE's Hensley Appointed to Union College Board of Trustees

December 17, 2021

Dr. Billy Hensley has joined his alma mater’s advisory group as an at-large member.

AFCPE Presents NEFE with 2021 Setting the Standard Award

December 08, 2021

NEFE was recognized as the Association for Financial Counseling & Planning Education® 2021 “Setting the Standard” Award winner.

2 in 5 Americans Admit to Financial Infidelity Against Their Partner

November 18, 2021

New survey analyzes financial infidelity among U.S. adults who report having ever combined finances in a relationship.

Request for Proposals – NEFE 30th Anniversary Celebration and Conference

November 17, 2021

NEFE has issued a Request for Proposals for an event planner or production company to assist in planning NEFE’s 30th anniversary celebration and multi-day thought leadership conference in Denver in early Q4 of 2022.

NEFE Case Study: How Stanford University Embraced the Personal Finance Ecosystem

October 20, 2021

NEFE spoke with Stanford University’s Mind Over Money team about their work and using the Personal Finance Ecosystem to contextualize their efforts.

Americans Display Concern, Optimism in New Poll on Financial Well-Being

September 30, 2021

NEFE’s recent survey is the latest in a series spanning a 16-month period that overlaps the pandemic in the U.S.

RTDNA and NEFE Announce 2021 Excellence in Personal Finance Reporting Award Winners

September 15, 2021

NEFE congratulates the winners of the 2021 Excellence in Personal Finance Reporting Awards.

What We’re Reading: A Review of the U.S. National Strategy for Financial Literacy 2020

August 30, 2021

NEFE’s summary and key takeaways from the Financial Literacy and Education Commission’s report

NEFE, Council For Economic Education Frame Key Financial Education Needs Through Extensive Policy-Focused Convenings

August 20, 2021

NEFE and the CEE have published summaries of a series of high-impact, policy-focused convenings with industry stakeholders, advocates, practitioners and policymakers.

NEFE Hits $5 Million Milestone in Research Grant Funding

August 19, 2021

The National Endowment for Financial Education has now awarded more than $5 million in research grand funding in support of financial education.

NEFE Retires Smart About Money, High School Financial Planning Program

August 02, 2021

NEFE has ended management of its financial education platforms to focus on new endeavors to support financial education.

NEFE, Higher Education Financial Wellness Alliance Agreement will Continue CashCourse

June 17, 2021

NEFE donates the entire CashCourse platform, including intellectual property and resources, to HEFWA as part of a philanthropic effort.

NEFE Names New Senior VP of Research, Impact

June 14, 2021

NEFE welcomes Beth Bean, Ph.D., as senior vice president, research and impact. Bean will oversee the expansion and application of NEFE’s research, insights and engagement.

Collaboration Is Vital to Improve Financial Well-Being

April 26, 2021

A true spirit of collaboration within the financial education community is necessary to unlock the doors to improved financial well-being for all Americans.

NEFE Digest

Inside, you'll find an archive of the NEFE Digest. These publications highlight NEFE's role in sponsoring research and innovative thinking in the field of personal finance.