Understand the Personal Finance Ecosystem

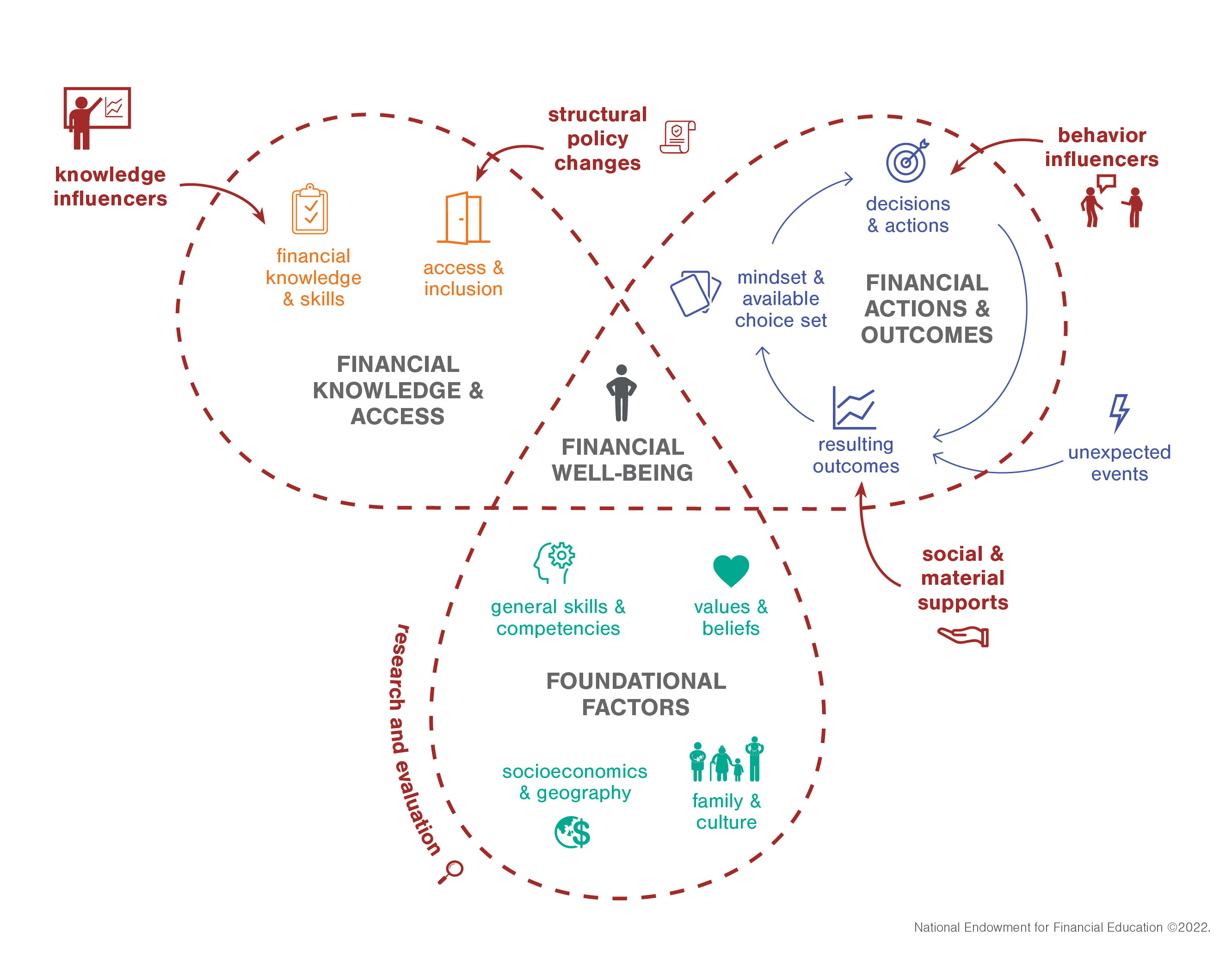

The Personal Finance Ecosystem is a research-informed framework that describes the factors influencing an individual’s state of Financial Well-Being.

View Full Version of Ecosystem

Watch Overview Video

View Full Version of Ecosystem

Watch Overview Video

General skills and competencies

Basic literacy and numeracy, problem-solving skills, critical thinking, information literacy, executive function, self-advocacy, communication, persistence, and other similar competencies.

Learn MoreGeneral skills and competencies influence all parts of a person’s financial life, from whether they have the vocabulary to understand the terms of a financial product to whether they know where to find trustworthy information. Like other Foundational Factors, general skills and competencies influence every part of the framework and are present for every individual. The impact they have varies based on a person’s lived experience.

Consider these examples:

- James struggles with math in the classroom and is easily overwhelmed by budgeting; he opts out of his school’s personal finance elective.

- Jin is a skilled negotiator and communicator and is never afraid to request more favorable terms on an account or raise questions when something doesn’t look right on a statement.

- Riley’s issues with impulse control make it difficult to save money; they often feel like they’re falling behind on their goals.

- Hana’s employer requires cybersecurity training; her knowledge makes her less susceptible to scams in her personal life.

- May is a refugee learning a new language and new concepts like credit; she finds translation difficult.

Socioeconomics and geography

Overarching factors like the state of the economy, socioeconomics and systemic inequality, and issues specific to a particular region or locale.

Learn MoreSocioeconomics points to the economic variability and systemic inequities that people experience, while geography acknowledges that many economic opportunities and challenges are place-based and can vary widely by region and zip code. As with other factors throughout the Ecosystem—and especially within Foundational Factors—an individual may not have full control over this aspect of their life.

Socioeconomics and geography greatly influence a person’s available choice set. Consider these examples:

- Imani lives in a state where schools are not required to offer financial education coursework and attends a school that is under-resourced; she wants to take a class to learn about personal finance but doesn’t have the option to do so.

- Ali is able to start a business with full funding from his family after graduating college with no debt; their generational wealth gives him a head start to building his own net worth.

- Pat would like to open an online checking account, but his community has limited Internet access; he lives in a rural area and finding reliable transportation to physical bank locations is a challenge.

Climate is increasingly relevant to these factors. Consider these examples:

- Drought, flooding, wildfire, and other climate-related events can wreak havoc on local economies dependent on agriculture and other land-based resources and industries.

- Natural disasters, rising sea levels, and changing flood plains can undermine homeownership as a way to build wealth.

- Insurance costs increase alongside climate risk.

- Some cities or regions lack the infrastructure to handle changing weather patterns, which can create unexpected financial hurdles for people.

Values and beliefs

Internal factors like motivation, affect, attitude, cognitive bias, time discounting, risk preference, stress, trust in the financial system, and other mental constructs.

Learn MoreValues and beliefs underlie how an individual approaches and experiences many of the other factors within the Ecosystem. They often impact a person’s willingness to learn and engage with financial practices in the first place. Values and beliefs can be conscious or subconscious, and they can change over time. Consider these examples:

- Sofia has very low levels of trust in the financial system and chooses not to use banking services.

- Malik is solutions-focused and tenacious in the pursuit of his goals; his strong sense of self-belief allows him to overcome many obstacles and setbacks.

- Kai is a single parent under enormous work pressure; their energy is devoted to the day-to-day and their sense of overwhelm makes it difficult to think about the future.

- Linda is a self-assured investor; she takes bold risks to build wealth for her family and is persistent despite big market swings.

Family and culture

Personal factors like family socialization, family composition, and culture.

Learn MoreCulture informs a person’s values and beliefs, and a person’s family often shapes their money mindset and behaviors. Culture can sometimes be overlooked as a footnote, but it’s often at the heart of people’s financial lives and their well-being. Importantly, traditional financial education—when unexamined and generalized—is susceptible to upholding systems of power and influence while reinforcing narrow views of the “best” or “correct” ways of managing one’s financial life. Consideration should be given to whether financial education efforts are prescriptive in a way that can be tone-deaf, misaligned, or oppressive to non-dominant groups. Consider these examples:

- A community prefers collectivism and pushes against individualist approaches to money management.

- Some religious traditions require refraining from charging or paying interest, but may continually be taught about it.

- Communities that have been discriminated against for generations at the hands of an economic system built on slavery and violence may choose not to participate in formal financial services because of their financial trauma.

Family financial socialization refers to the ways that financial knowledge, attitudes, and behavior are transmitted and developed within a family setting. Consider these examples:

- Elena’s family talks about money openly and frequently, while her friend’s family considers it a taboo topic; unlike her friend, Elena engages with financial topics. whenever she can and is comfortable and confident in making financial decisions.

- As an adult, Anders mimics his parents’ financial habits, while his sister Liv rejects what was modeled to

Family composition also affects financial life. Consider these examples:

- Alejandro lives in a multigenerational household, and some family members’ documentation statuses make it difficult to find work.

- Hannah experienced an expensive divorce and lost her home; she is living with friends until she can afford her own apartment.

- Amara’s mother has many children to support, so Amara picks up odd jobs after school to help pay the bills.

Financial knowledge and skills

The objective mastery of financial definitions, terms and concepts, and the skills that equip individuals to translate that knowledge into decisions and actions.

Learn MoreFinancial knowledge—paired with the skill to decide or act—is how many people think about financial capability. Financial knowledge is the mastery of financial definitions, terms, and concepts. Financial skills determine whether an individual can make decisions with that knowledge.

Financial knowledge and skills connect to many parts of the Ecosystem: they are influenced by Foundational Factors; they influence Financial Actions and Outcomes—mindset and decision-making, in particular; and they are difficult to develop and practice without access and inclusion.

Skills are what put knowledge into action. Consider this example:

- Carmen knows that an 800 credit score is excellent, but she lacks the skills needed to increase her own score.

- Micah learned about strategies for saving money, but his financial resilience to income shocks improved most when he had access to rainy day savings funds.

Access and inclusion

The opportunity to participate—by taking action and exercising choice—in financial society, including financial markets, the financial services industry, and all aspects of financial life.

Learn MoreIndividuals face numerous barriers to full inclusion, most of which are systemic. Access and inclusion are influenced by Foundational Factors. Consider this example:

- Elijah’s family has lived in the same neighborhood for generations. Because of the historical practice of redlining, there are no physical bank branches in his community. With the long commute and his irregular work schedule, it’s difficult to get to a bank during their regular hours. Instead, he chooses to incur high fees at a nearby check-cashing business.

Mindset and available choice set

An individual’s attitudes or mindset at the time they make a financial decision (which might change or persist over time) and the choices available to them, both of which are influenced by Foundational Factors, Financial Knowledge and Access, as well as outcomes from previous actions.

Learn MoreThe starting point of the Financial Actions and Outcomes cycle is mindset and available choice set. Mindset is a set of mental attitudes at the time of a financial decision: in other words, how a person feels about a decision going into it. A choice set describes the options available to an individual.

Financial Knowledge and Skill flow into mindset and available choice set, including a person’s confidence, objective knowledge, and how they apply that knowledge to the choice at hand. Consider this example:

- Ava took a first-time homebuyer’s workshop at her local credit union after spending several years saving for a down payment. Her goal is in sight! Because she feels well-equipped to act in her own best financial interest, her mindset and available choices have shifted.

Not everyone has the same set of choices. Consider these examples:

- Louis has a high school diploma but no other continuing education, so he will have a different set of job opportunities than someone with a graduate degree.

- Kali’s credit score is high, so she has a much better set of contract terms when obtaining a loan than someone with a lower score.

Decisions and actions

The presence or absence of decisions made and actions taken by an individual, based on mindset and available choice set. Whether an individual makes choices that positively impact their financial well-being can be influenced by other factors.

Learn MoreFinancial decisions are made all the time, from small daily purchasing decisions to big-picture choices like where to live, what job to take, or whether to start a family. Sometimes the absence of a decision or action can be just as consequential. Consider this example:

- Mia is nervous about having enough money to pay back her student loans and cover her expenses after moving to a new city. When she lands a job with a company offering a match in their retirement plan, Mia does not opt in. She is overwhelmed by the paperwork and wants her paycheck to be as big as possible, and she figures she can sign up later—but she doesn’t.

While financial well-being is something an individual defines for themselves, financial actions and the results of those actions play a large part in that well-being.

Resulting outcomes

The results of decisions and actions (or indecisions and inactions) as well as external events, which can be objective or subjective.

Learn MoreOnce a financial choice or action is made, an outcome happens. Outcomes can be objective (like having a new bank account or a lower credit score) or subjective (like feelings of satisfaction or confidence). These outcomes once more feed into mindset and a new set of available choices, and the cycle repeats. Consider this example:

- When faced with two job offers, Omar takes the job with a lower salary because it will allow him to spend more time with his family. The result is that Omar will have to offload some of his larger expenses and scale back his spending, but he also feels empowered to do so because his choices are aligned with his values. For him, social wealth is more important than maximizing his income.

Unexpected events

Resulting outcomes are also influenced by external events, whether positive (such as a wage increase or windfall) or negative (such as a car repair, large health care bill, or incidence of fraud). Sometimes these are referred to as economic shocks.

Learn MoreNot all financial disruptions can be prepared for nor are they all outflows of financial decisions and actions. Like several other components of the Ecosystem, there are some things that an individual cannot change or control, but they still impact the outcomes that a person experiences.

Why are unexpected events placed outside the diagram?

Unlike the rest of the factors in the Personal Finance Ecosystem, which are always present for an individual, unexpected events exert force on the Ecosystem sporadically. For example, factors like objective financial knowledge may be high or low but are present nonetheless. In contrast, unexpected events pop up unpredictably within the Financial Actions and Outcomes cycle.