NEFE’s Role in the Ecosystem

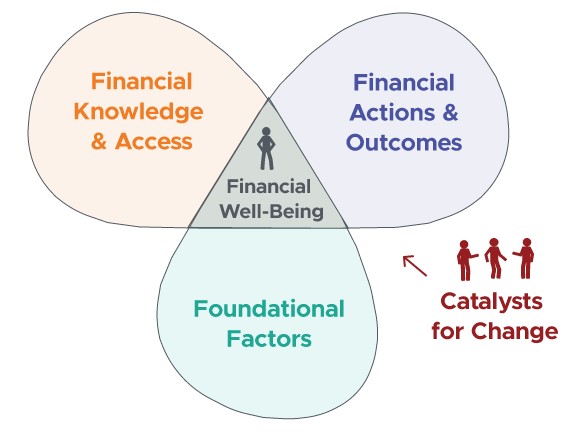

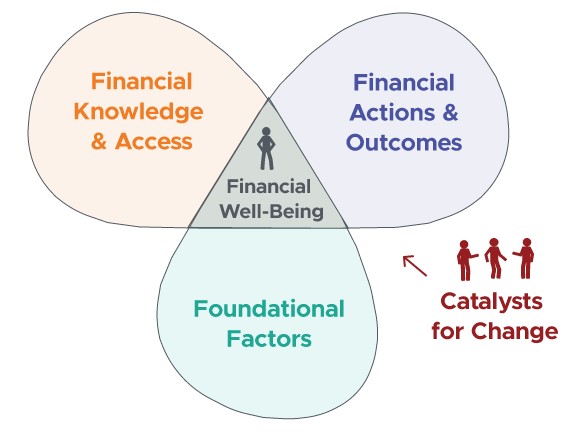

NEFE first developed the Personal Finance Ecosystem to examine how financial education efforts fit within the broader context of the financial well-being field. The Ecosystem continues to illustrate the limitation of a financial-education-only approach to financial well-being.

A brief history of the Personal Finance Ecosystem

The Personal Finance Ecosystem is an evolving framework first conceptualized by NEFE in early 2019 to synthesize observations from research and practice across the financial well-being field.

In the years that followed, and in consultation with the field, the model evolved a second and then a third time. The current version—released in 2022—is a product of extensive, evolving feedback and field-tested concepts and visuals.

Learn MoreLearn more about prior versions

NEFE’s first model was upgraded to the shape of a multi-layered pyramid in late 2019, but it was often misunderstood to imply that Financial Well-Being is a destination. The current version removes implications of hierarchy and better communicates that Financial Well-Being is not a point of arrival, but is an ever-present state, experienced by every person, that fluctuates over time.

Other changes include the addition of several new Ecosystem factors and two more Catalysts for Change, as well as revising language to be more inclusive and intuitive to those outside of NEFE’s field.

Prior versions of the Personal Finance Ecosystem are available for reference and can be found using these links:

Personal Finance Ecosystem Version 1

Personal Finance Ecosystem Version 2

Personal Finance Ecosystem Version 3 (Current Version)

Where does NEFE fit within the Ecosystem?

Throughout NEFE’s history, its mission has anchored on championing effective financial education. Therefore, NEFE has devoted much of its attention to supporting knowledge influencers, one of the Catalysts for Change that impacts Financial Knowledge & Access. But NEFE’s position in the field as a centralizing voice providing leadership, research and collaboration to advance financial well-being has driven us to think more broadly about catalyzing change across the Ecosystem. This framework helps NEFE lead critical conversations about financial education while also highlighting opportunities for our field to work together to advance financial well-being for everyone.

What the Ecosystem tells us about financial education

The Personal Finance Ecosystem was first conceived to place financial education within a broader context and to help manage expectations for what financial education interventions could achieve. While financial education is vitally important, it does not exist in a vacuum and cannot be expected to overcome systemic barriers that hinder many people’s financial well-being.

Similarly, financial education and other knowledge influencers can and should be expected to influence knowledge gain; their goal should not be to overcome other factors present in the Ecosystem. It takes a full range of Catalysts for Change—all acting on different parts of the Ecosystem—to make our field successful in increasing financial well-being for all.

Learn MoreQuality financial education matters

The Personal Finance Ecosystem highlights the importance of quality financial education and how an increase in Financial Knowledge and Skills could have spillover effects into many other parts of the Ecosystem. While financial education alone cannot overcome barriers toward full inclusion or solve the economic inequity that exists across socioeconomic status, race, and gender, it can help people navigate the world—and accompanying financial systems—as it exists. When designed and delivered at its best, financial education can help people to analyze their values and goals in life and better understand how decisions can impact their financial future; provide information to reduce power imbalances between them and the financial industry; help people know what sources and tools are available to help them when needed; and build empowerment even when real financial or social constraints exist.

How to use this resource

NEFE built this website to assist people in learning about the Personal Finance Ecosystem to:

- Better understand the full range of factors influencing financial well-being.

- Build imagination for the unique lived experiences of individuals, while recognizing the unseen forces at play within their financial lives.

- Contextualize financial education within the broader financial well-being landscape, to understand both its benefits and limitations.

- Draw attention to systemic inequities across the Ecosystem and motivate the structural changes that are needed to advance financial well-being.

- Orient themselves to the financial well-being field.

- Spark ideas for collaboration, partnership, and participation within movements for change.

- Calibrate expected outcomes to align with specific interventions; financial education is not a panacea, nor is any other single Catalyst.

- Prompt research questions and open new lines of inquiry.

In addition, NEFE is developing a suite of tools to help you share and use the Personal Finance Ecosystem in your work. Find current materials—including a worksheet, slide deck, classroom activities, and more—on the Use the Ecosystem to Support Your Work page.