Explore Stories of Well-Being

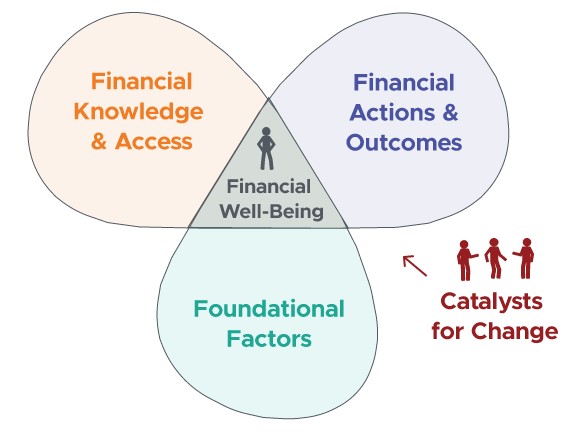

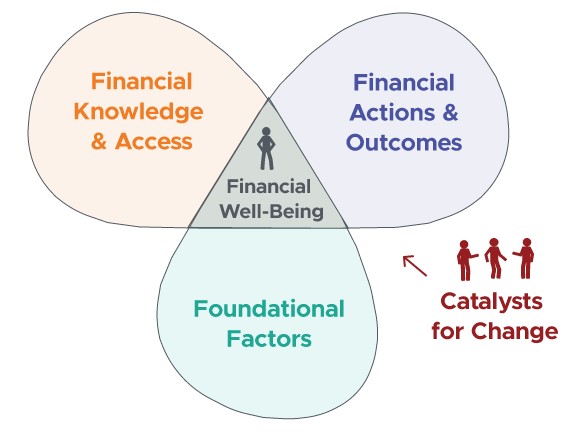

Listen to the stories below of the Personal Finance Ecosystem in action to understand how factors influence Financial Well-Being in individual ways over time.

Unique to the individual, and self-defined by them

While the same factors are relevant for all individuals, the way they collectively influence a specific individual is unique.

A fluid, ever-changing state, that changes over time

An individual never “achieves” financial well-being as it is not a static end point.