We continuously reflect on our successes as well as failures to speak authentically and transparently about what works and what doesn’t in improving financial well-being. Educational and behavioral change theories are tested for validity through research and practice, so that the guidance we offer originates from proven results.

Initiative Highlights

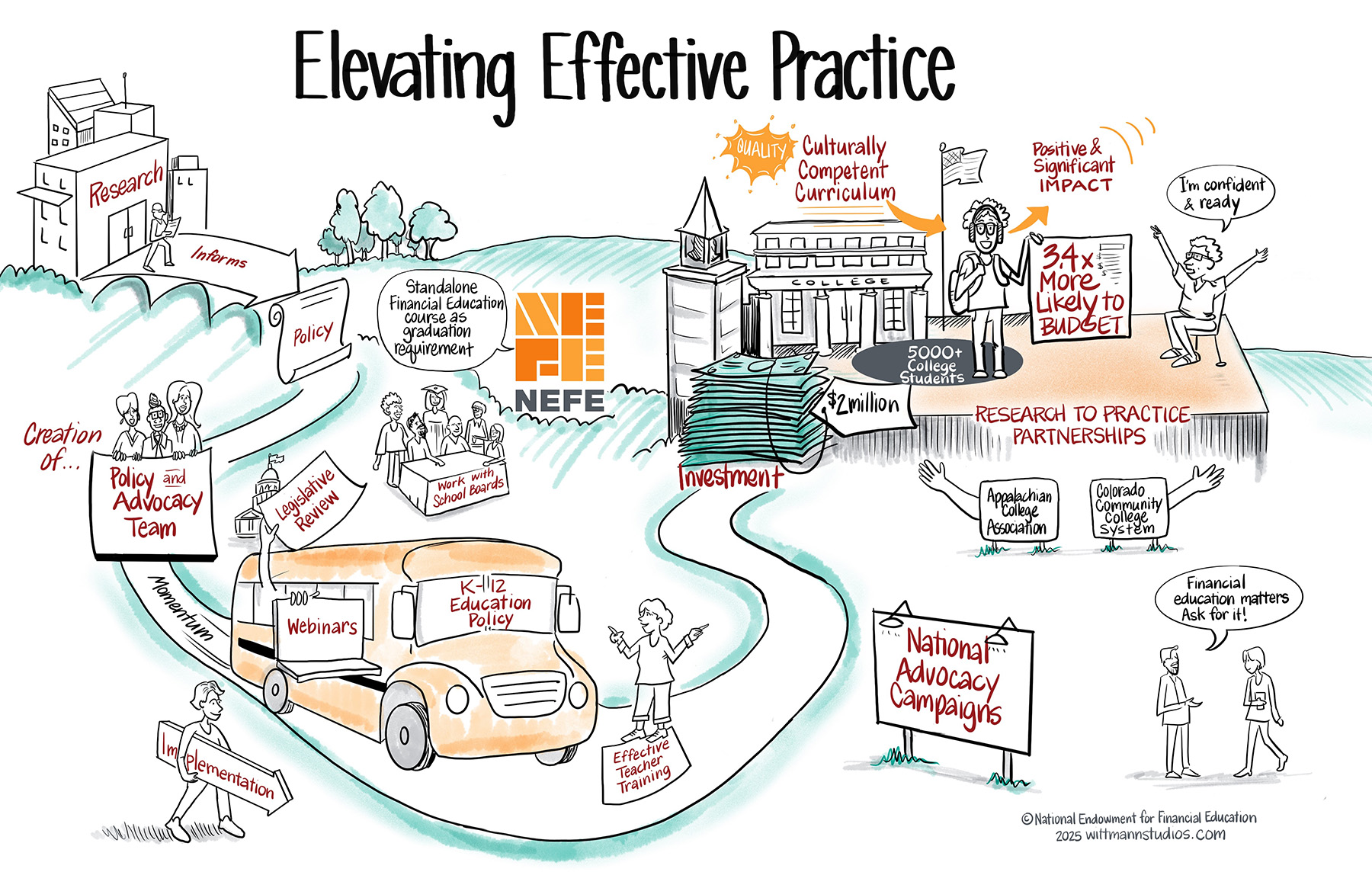

- Committed $2 million to strategic research-to-practice partnerships.

- Launched Policy and Advocacy unit to provide guidance on policy at the state and federal levels.

- Partnered with the Council for Economic Education to develop a series of Nationwide Policy Convenings to discuss opportunities and challenges when considering statewide policy and programming.

- Began actively tracking legislation of K-12 graduation requirements across states.

- Supported decision makers, leaders and advocates in making the case for requirements and the factors for quality implementation.

- Assisted in the development of the National Standards for Personal Financial Education in collaboration with the Jump$tart Coalition for Personal Financial Literacy and the Council for Economic Education.

- Joined the FinEd50 Financial Education for America initiative as a coalition member to improve access to quality financial education in every state.

Strategic Partnerships

In 2022, NEFE launched a strategic partnership initiative to establish a research-to-practice laboratory, investing over $2 million into two partnerships with the Appalachian College Association (ACA) and the Colorado Community College System (CCCS). Each partnership advances effective, population-specific practices and provides guidance and support for the future of the financial education field.

The ACA partnership focuses on rural, first-generation college students. Seven colleges executed tailored financial education interventions throughout 2024, including embedded learning in a required quantitative literacy course for freshmen and hiring and training peer mentors. The CCCS partnership focuses on community college students who are often older, more racially diverse, and more likely to study and work part-time compared to traditional four-year undergraduates. Initial findings from these partnerships show a statistically significant impact on financial knowledge and well-being for over 5,000 college students. Students were 3.4 times more likely to start budgeting, and overall program satisfaction was high.

Policy and Advocacy

NEFE provides guidance on financial education policy at the state and federal levels using an effectiveness lens centered on research and historical data. Our focus is on driving the conversation, convening thought leaders and amplifying research.

We developed an interactive policy map to help stakeholders stay updated on the latest developments in K-12 graduation requirements across all 50 state legislatures, the District of Columbia and the U.S. Congress.

The expansion of K-12 requirements continues to gain momentum, with 26 states (as of March 2025) now requiring personal finance coursework for high school graduation. NEFE remains committed to supporting this growth through analysis and guidance, annual legislative reviews and forthcoming policy position papers that will explore effective practices and challenges of effective implementation.

NEFE advocates for a minimum of one semester of instruction—whether a one-semester stand-alone course or embedded in a year-long course if it includes at least a semester’s worth of time and material dedicated to financial education. Providing evidence of impact through evaluation is necessary to improve teaching methods.

National Standards

NEFE has supported the review of the National Standards for Personal Financial Education, a unified framework developed by the Jump$tart Coalition for Personal Financial Literacy and Council for Economic Education. These standards guide educators, curriculum writers, policymakers and other stakeholders to promote effective, comprehensive financial education for K-12 students.

FinEd50 Financial Education for America

NEFE is a member of the FinEd50, which includes nonprofit organizations, researchers, corporate partners and professional organizations working together to advocate for financial education. The initiative aims to help individuals navigate their financial lives, make informed decisions and take control of their financial futures.

Moving Forward

We remain committed to providing guidance to educators, researchers, policymakers, thought leaders and advocates based on proven results backed by data. Our ongoing initiatives include:

- The upcoming release of policy position papers on effective implementation.

- Advocacy in states without graduation requirements, focusing on implementation challenges and opportunities in states that have recently introduced graduation requirements.

- Recognition and celebration of states exemplifying best practices for effective legislation and implementation.

- Ongoing assessment of current strategic partnerships to explore program applications that inform best practices in financial education delivery.