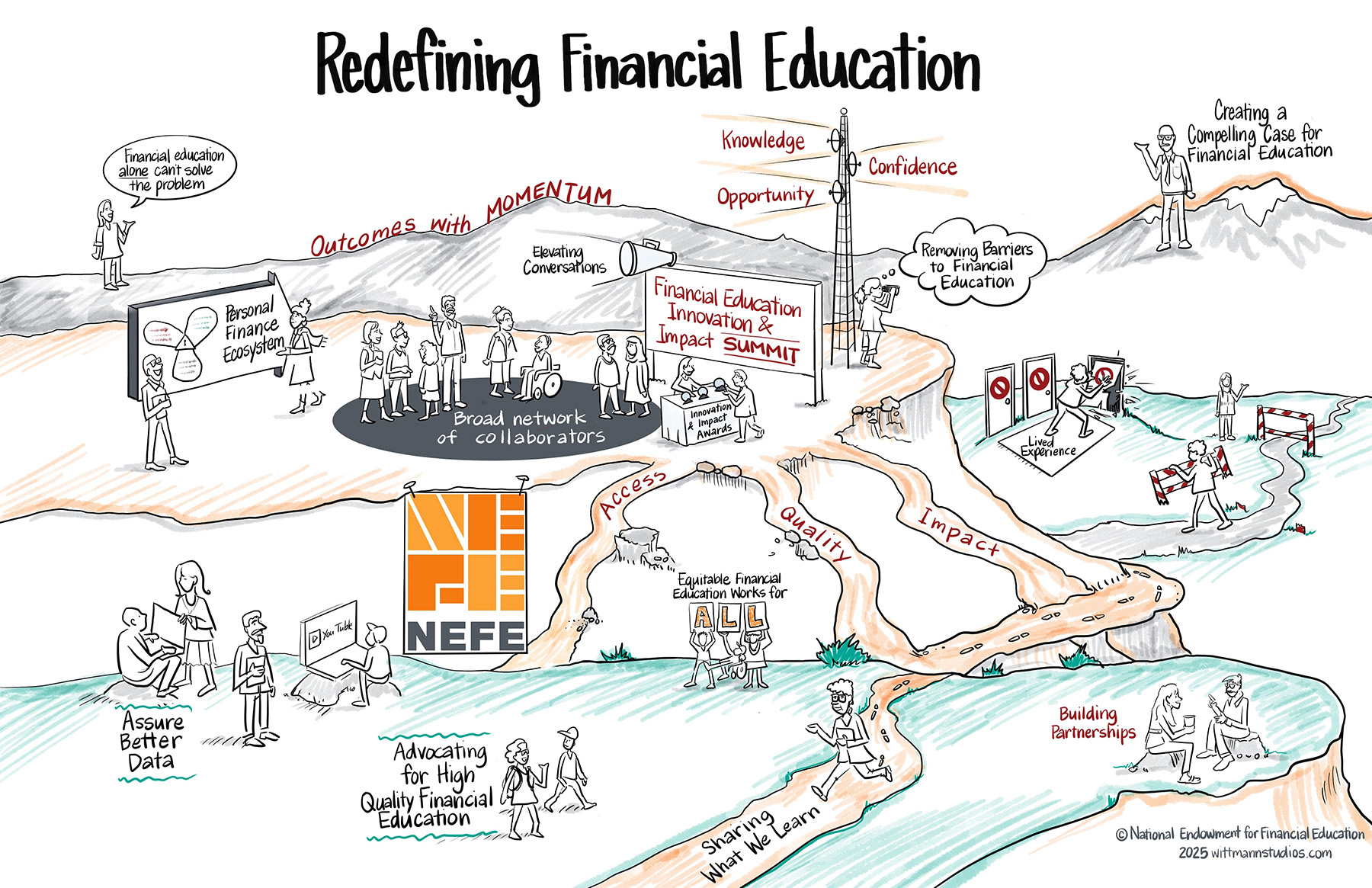

We amplify our role as a champion of effective financial education, pursuing theories, research and policy based on equity, innovation and impact. We openly discuss the benefits and limitations of financial education within the financial well-being landscape, recognizing that education alone is not enough to overcome systemic barriers toward full financial inclusion.

Initiative Highlights

- Retirement of curricula and remaining direct-learning programs in 2021 to redeploy resources toward the elevation of research, evaluation, policy and thought leadership.

- Transition of CashCourse to the Higher Education Financial Wellness Alliance at Indiana University.

- Development, contextualization and ongoing adaptation of the Personal Finance Ecosystem.

- Hosting the Financial Education Innovation & Impact Summit, a biennial convening for educators, researchers, policymakers and advocates.

- Creation of the Innovation Awards and Impact Awards to honor excellence in financial education.

- Prioritization of equity and inclusion across NEFE’s work to better understand and create effective approaches to advance financial education among different communities.

- Established staff position of Senior Vice President, Equity and Engagement.

- Launched the visiting scholar program in 2022 to study and adopt effective approaches in financial education for underserved populations.

- Received awards including the 2021 “Setting the Standard Award” from the Association for Financial Counseling & Planning Education® for focus on Diversity, Equity and Inclusion and "Best Financial Nonprofit” in Bankrate.com’s 2022 Social Honors for building access to equitable and effective financial education.

- Significantly expanded relationships and partnerships with organizations whose mission is to serve vulnerable populations.

A Transformation from Learner-Facing Programs to Field-Service

Program Transformation and Retirement

After extensive market research which assured the demand for these programs would be met successfully, we implemented a program retirement strategy. This strategy included consistent communications and timelines mindful of the schedules of teachers, students and practitioners. Program retirement began in 2019 with On Your Own, My Retirement Paycheck, Financial Workshop Kits, Financial Four and Spendster. In 2021, NEFE retired its remaining programs: the High School Financial Planning Program® (HSFPP), CashCourse® and Smart About Money (SAM). This change was an important part of our strategic shift. Once SAM and the HSFPP were officially retired, CashCourse was transferred to the Higher Education Financial Wellness Alliance for continued use, including all intellectual property, as well as grant funding and consultation through 2023 to ensure a smooth transition. This evolution away from programming, which consolidated 10 websites and eight brands to one, allows NEFE to focus on broader collaboration with practitioners, advocates, policymakers and researchers in financial well-being.

Focus on Equity and Inclusion

Drawing upon proven practices in educational pedagogy, NEFE recognizes there is no “one-size-fits-all” model for our work. Rather, our ability to understand and center the needs, experiences and identities of those we serve are paramount for the pervasive and sustainable success of financial education. To steward these efforts, NEFE engaged in internal work to advance cultural competency among teams; built relationships with organizations whose mission is to serve underrepresented communities; advocated for the development of culturally relevant curriculum in K-12 legislation; and facilitated deeper conversations and considerations of equitable financial education through our research awards, a visiting scholars program, webinars, roundtable discussions, speaking engagements and publications. In a broader context, NEFE recognizes the shifting landscape surrounding equity and inclusion. These shifts illustrate the critical need to ensure meaningful and actionable approaches to continue to advance financial well-being for all.

Personal Finance Ecosystem

The Personal Finance Ecosystem (PFE) is a research-informed framework developed by NEFE to help practitioners, researchers and policymakers understand the many factors that comprise and influence an individual’s financial well-being. Since its debut in 2019, we’ve used feedback, observations and data to refine the PFE. The latest iteration elevates important foundational factors such as values and beliefs, family and culture, and socioeconomics and geography. These changes highlight the importance of economic inequities and cultural factors at play. The expanded Catalysts for Change recognize the range of individuals and organizations helping people to live their best financial lives. The Personal Finance Ecosystem is cited in research, used in college classrooms and is often used by educators and advocates, resulting in streamlined industry language and scope. It has also resulted in more than 23 NEFE speaking engagements since version three was released in late 2022.

Financial Education Innovation and Impact Summit

The Financial Education Innovation & Impact Summit (FEI&I Summit) was created to improve financial education through the collaboration of interdisciplinary leaders. This biennial conference was first hosted in December 2022, and a second FEI&I Summit was hosted in October 2024, with a 96% overall satisfaction rating and 98% of respondents reporting their attendance made them “feel more connected to the financial education field.” The events featured content and programming across three essential tracks—quality, access and impact—all with a focus on equity. Keynote speakers, panel discussions, breakout sessions, networking opportunities and post-conference meetings provided actionable visioning, learning and new relationships. At the conclusion of the 2024 Summit, 94% of respondents said they identified key takeaways they could apply to their work. Collaboration with advocates from various backgrounds and industries to discuss financial capability is a core value at NEFE, and we remain committed to hosting these convenings and sharing ideas and outcomes through thoughtful dissemination.

Moving Forward

We are committed to championing effective financial education through current and ongoing initiatives:

- Launching a new Personal Finance Ecosystem learning experience and turnkey resources at www.nefe.org/ecosystem, with continued evolution of the framework from partner feedback and testing.

- Dissemination of key learning outcomes from NEFE’s 2024 Financial Education Innovation & Impact Summit, as well as planning future convenings.

- Revising the Five Key Factors for Effective Financial Education to support educators and overcome implementation challenges.

- Convening an equity in financial education Action Council among key stakeholders from across the financial ecosystem.

- Crafting a new research agenda that will focus on the impact to communities/the broader economy when effective financial education interventions are not readily available.

- Creating a new educational framework to support the delivery of financial education for our most vulnerable communities.

- Identifying and connecting organizations focused on equitable and inclusive practices in financial education to research, resources and partners across the financial ecosystem.